Key Takeaways:

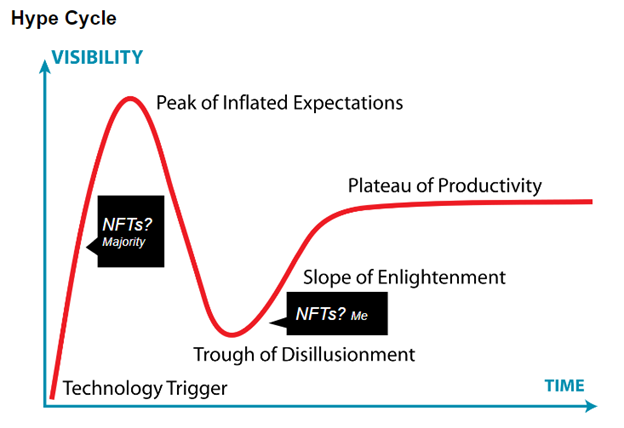

- NFTs are beyond the peak of inflated expectations and trough of disillusionment, climbing up the slope of enlightenment in digital art and digital collectibles

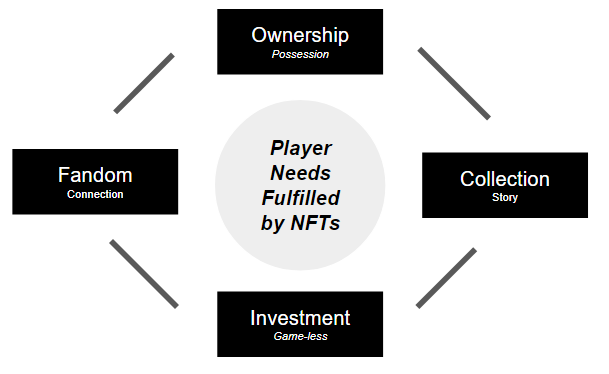

- NFTs enable player needs of ownership, collection, fandom, and investment, making them a compelling fit to be applied as a technology to gaming

- Existing games using NFTs like Axie Infinity have created compelling NFT economies: what’s left to happen is integrate a compelling gameplay meta with the collectible/investment aspects in a decentralized fashion

NFTs Outside Gaming

Put Aside the Hype

Since the 2017 peak of inflated expectations, the world has been on the lookout for actual, interesting blockchain applications beyond cryptocurrency store of wealth, investment, and payments. Plenty of time and effort was put into development, but when would it turn into users and cash? Late 2020/early 2021, it turns out. Today, that reality is playing out with non-fungible tokens (NFTs) in the digital collectibles and digital art worlds.

For technoskeptics, NFTs are just the latest in Doge/SPAC/Money printer excess, a bubble bound to collapse. There are certainly bubbly components to the market, and the technology is also closer to the 2001 tech bubble than the 2021 technology domination of the stock market. But beneath the bubbly excesses are also a very serious set of bleeding edge technologists. A few of whom might become like Brian Armstrong (now worth ~$20 billion and in the Buffett/Gates tier of donating all of that money for the good of the world) in 2013.

Up the Slope of Enlightenment

Take the world of digital art. Non-fungible tokens are solving real problems in the art world. Anyone can put up a faked Picasso on their wall, or profit from art owned by a dictator. With digital art on the blockchain, it gets to take advantage of blockchain features: the public ledger is there for everyone to see and trace. No fakes. Furthermore, if you do not want to trade with a known Al Qaeda, or other money-laundering wallet, that information is also available for you to verify on the blockchain. Thousands of pieces of art from Jews murdered or dislocated during the holocaust sit in our museums. With NFTs, these pieces can easily be identified, and returned to their heirs ethically.

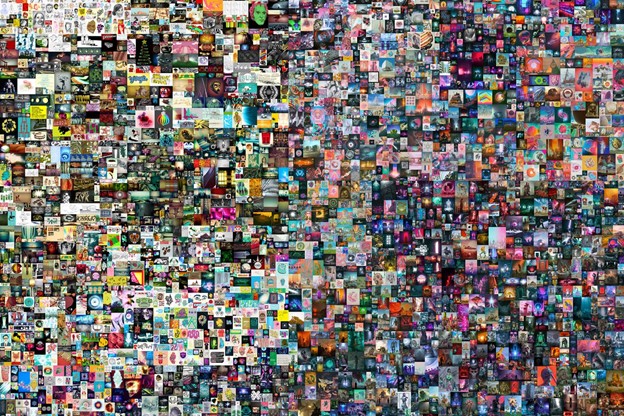

If those two levels of value were not enough for buyers of art, NFTs also offer a revolutionary method of payment for artists – allowing them to profit off the resale of their work and make money off digital art at all (whereas people before would just download the jpg and you had to work in tech art on 3d in proprietary software to get paid – an office job, hardly the artist life). Could we see a new age of artists now that they can make a living? The potential to grow the overall market is tremendous. This level of added functionality helps explain Beeple’s $69 million auction at Christie’s. NFTs are entering the 40,000-year-old art market and offering disruptive innovation.

Then shift to the world of digital collectibles. For thousands of years now, humanity has had to rely on certificates of authenticity, experts, and trust to verify the validity and uniqueness of collectibles. In Phillip K Dick’s classic The Man in the High Castle, Childan’s Americana antique shop sells counterfeit antiques. Thanks to NFTs, and the blockchain’s public ledger, counterfeits are no longer a problem. Everything is verifiable and out there in the open. This consumer advantage is like the one seen in digital art.

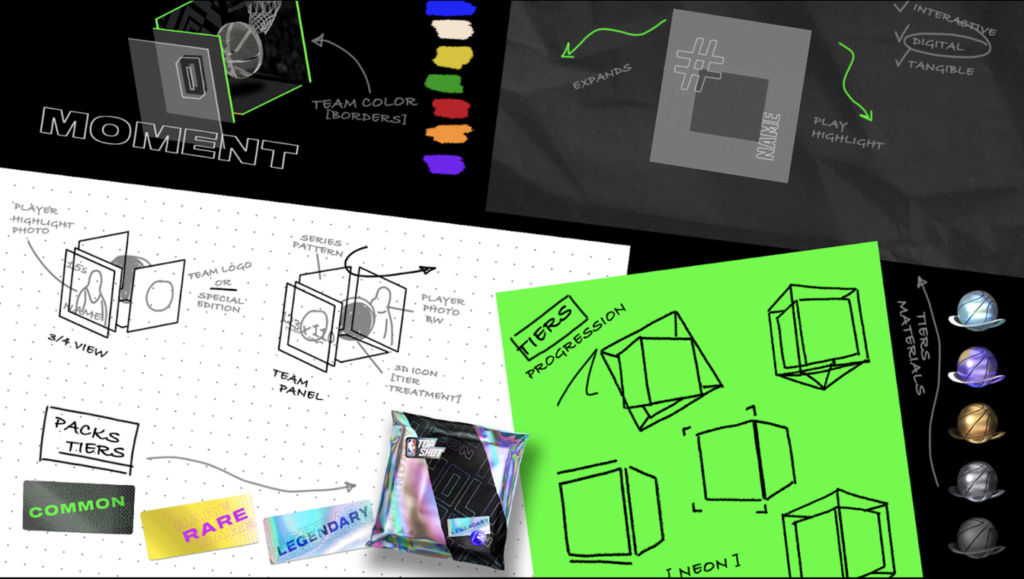

NFTs also play the critical role of enabling digital collectibles in the first place. Before NFTs, digital collectibles were not a market because everything was so easily copied. With a public ledger, the space has finally opened up for digital collectibles to exist. This problem solving helps explain NBA Top Shot’s over $230 million in transactions (Roham Gharegozlou looks set to be one of the future Brian Armstrong’s I teased, with Dapper Labs raising at a $7.5 billion valuation). A Top Shot Moment is a 3-D looping basketball clip – a unique item impossible in the physical world. This digital market can move faster than physical markets. It was actually the first place a LaMelo Ball collectible was even available. Through these ways, NFTs are disrupting the massive collectibles market (here I have defined trading cards as a subset of collectibles, though I have heard others describe them as distinct and NFT enabling a trading benefit as well).

To tie it all together: in the digital art and digital collectibles worlds, NFTs have found applications for buyers and sellers that are bringing the technology up the slope of enlightenment.

NFTs In Gaming

The question of the day is, “will gaming emerge as another application for NFTs along the slope of enlightenment?”

Technology Applications

What they are and can do

NFT is simply a file format for transferring data and information on a blockchain network. It could be anything from an NBA moment to a video game mechanic. That is what makes it so interesting: with code, you can add value to the game. Many NFTs on the Ethereum blockchain implement a smart contract on top. That is how an artist, for example, can receive a portion of the sales of her art as it is traded after her initial sale. The terms are coded into the smart contract.

There are many forms of NFTs and one of the most common is the ERC-721, created for CryptoPunks. Overall, these technologies add several key values: they can help provide a decentralized marketplace, without relying a game publisher to maintain a server; they can be a modular marketplace solution that is plugged into games; they can be used to trade assets; they can be used to store value and be traded in/out of fiat based on supply and demand.

What they are not and cannot do

NFTs are not cryptocurrencies. Many games with NFTs have a cryptocurrency element, but they are separate concepts. NFTs are unique, embedded in the blockchain, but not currencies or tokens. If anything, they are an alternative to cryptocurrencies when it comes to investment and store of wealth, representing an alternative digital asset class in and of themselves.

There are also limitations to the technology; though, with our technoutopian hats on we can see how future NFTs solve some of these issues. One of the largest limitations, for instance, is that NFTs on the Ethereum blockchain have been subject to the chain’s congestion and seen fees in the range of $70. Dapper Labs dealt with that in NBA Top Shop by using the Flow blockchain.

Another limitation is counterfeiting in other forms – e.g., reissuing a digital asset with minor changes as their own. At the moment, this is solved by using a trusted creator or closed ecosystem. Another limitation might be the self-custody nature of these assets. There is no FDIC insurance. Lose your wallet, and you are out of luck. Using a trusted platform may be the solution to this problem as well, but has the disadvantage of not being decentralized. A final limitation is that blockchains tend to be energy intensive. While these issues are real, I see them more as opportunities for businesses to solve them than barriers to success (a la Coinbase solving secure fiat/crypto conversion).

Player Needs

Now, to the juicy stuff – what are the player needs that NFTs can deliver for gamers on? Perhaps the primary mode of value from an NFT comes from the sense of ownership and possession. That is why its earliest successful applications have come in art and collectibles. As Finish Line says about Top Shot, “it’s about the glory, the bragging rights and the exclusivity.” Gamers have also been trained to feel a sense of ownership and satisfaction; while Free Fire is free, millions of gamers are willing to pay up to own cosmetics. So, we can see NFTs solving the need of unique ownership over rare cosmetics, for example, in gaming.

NFTs also serve a player need towards the end of a gamers’ lifecycle. When gamers quit a game, the investment is gone. It does not mean anything. But if gamers could either: 1) sell what they bought when they quit, spending becomes investing, or 2) transfer the cosmetics to the next game they are playing, then they become game-less game pieces.

In addition, they serve as collectors’ items – the digital collectibles use case brought to gaming. One could imagine players passing down NFTs across generations. At this point, the NFT can serve psychological story needs for the gamer as well. Like a wedding ring is imbued with extra value to its owner, an NFT cosmetic from one’s grandfather when he played Roblox could have even higher intrinsic value.

NFTs can also serve a role in fandom. Users who want to express a great connection to Jack Dorsey’s first tweet, for instance, can buy that. Fans who watched a particular dunk highlight from LeBron James can buy that. Similarly, in gaming, players might be able to buy the gun wrap a Call of Duty: Warzone competitive player used to win the biggest prize.

Notable Market Examples

Axie Infinity

Axie Infinity is perhaps the most exciting of the bunch, claiming over 19 thousand monthly active onchain users, plus sporting some huge dollar value deals. In the game, Players build kingdoms while managing wild creatures called Axies. The land and the Axies are bought as NFTs.

What is especially interesting about Axie is the land being purchased by other game developers. Yield Guild Games bought 88 plots of Savannah land in Axie Infinity for $76K. It will be very interesting to see the gameplay deployed upon it.

Enjin

Enjin is perhaps the second most advanced company in the space. Instead of developing a game itself, Enjin is a platform company. They build products that make it easy for game developers to use NFTs. It boasts an SDK for Unity to enable the thousands of devs on the platform build NFTs into their games. It also developed the ERC-1155 standard, which enables a smart contract to govern an infinite number of tokens. Their Enjin coin (ENJ) has seen a meteoric rise as of late.

Enjin is behind what Playtoearn.net rates as the #1 top play to earn blockchain game as of writing (4/18/21), Lost Relics. This is a game that is very light on graphical quality or cinematic quality but claims a fairly large numbers of users, for the space as it stands today.

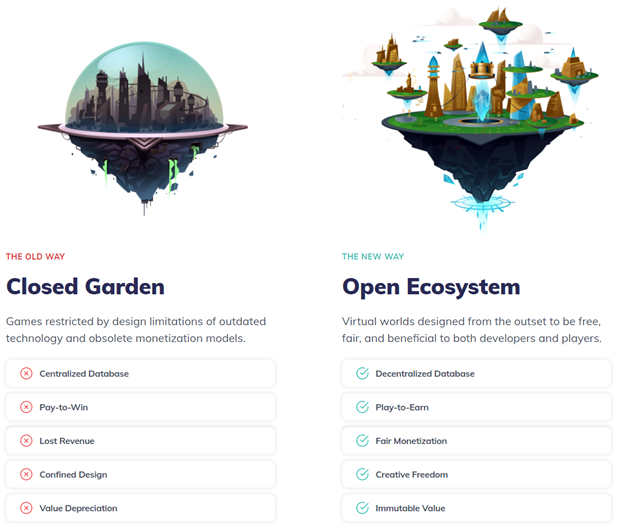

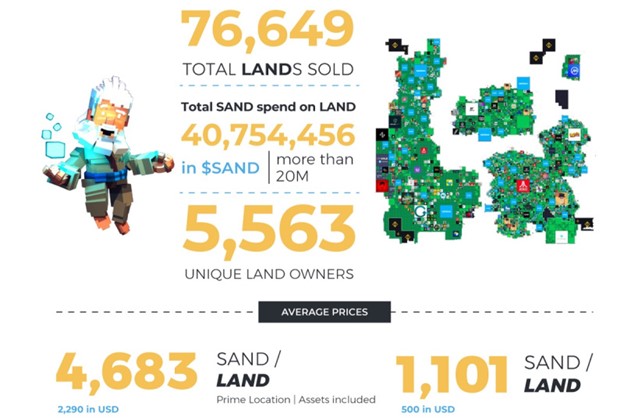

Sandbox

What is notable about Sandbox is they have done what most gaming industry professionals are asking themselves, “should I add NFTs to my game?” Sandbox was a 10 year old IP with 40m installs. They built upon that creator tool to allow creators to monetize with NFTs. These voxels can have 1000s of blocks and build 3d art, and have attributes used in the Sandbox virtual world. Their game creator allows you to build animations and attributes on top of the art. If Enjin is operating like at the Unity level of the platform stack, Sandbox is operating at the Roblox or Minecraft level.

Players convert fiat into SAND crypto and then the platform has four types of NFTs: game entities, wearable, equipment for avatars, and art. The initial sales have been going well. It is particularly interesting that multiple gaming brands have already signed on. Atari, for instance, has; and the Sandbox has over 60 partnerships, across genres, including The Smurfs, Care Bears, and CryptoKitties.

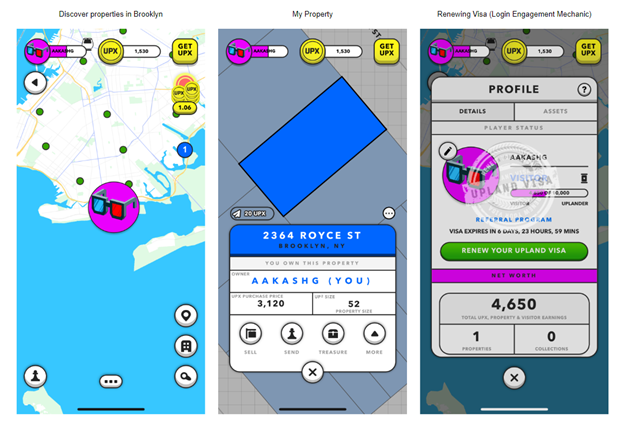

Upland

Upland is an interesting NFT-first game that has real estate sim vibes. The creators have a compelling vision of the metaverse as a digital representation of the real world, and eventually what might be presented as a digital overlay to the real world via Google Glass-like AR-tech. Today, they offer a mobile app and discord community. In the app, you can buy parcels of land in real cities reflecting real buildings (SF, NYC, and Fresno to start). As you might expect, Manhattan property is much more expensive than Brooklyn. Players get UPX, the games’ currency, for login rewards, competing in discord announced contests, or via spending.

Although they intend to build out additional functionality like gameplay, art, converting out to fiat currency, none of that is available today. This is a beta release game with several other claims about future crypto and NFT integrations which are not present today, but interesting to contemplate like art being transferred from other games into your property here.

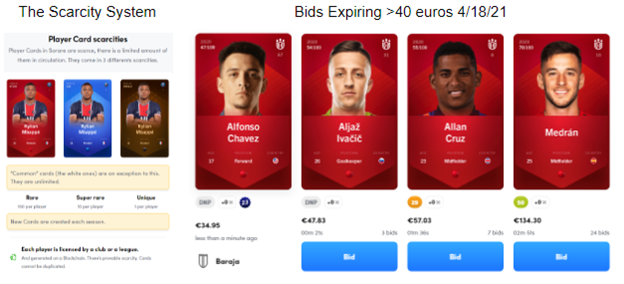

Sorare

Compared to Upland, Sorare actually does have gameplay with things like the One Shot League. The gameplay is quite developed compared to most NFT games, and it has a compelling auction marketplace where cards are being sold for fairly high amounts.

However, today, the gameplay itself is not at the level of other fantasy games. One would think, with its Ubisoft tie up, there would be compelling fantasy gameplay. The One Shot League is actually worse than just the typical Sorare experience. But Yahoo Fantasy Sports is still several decades ahead, especially in terms of stats and content. There is certainly nothing like the amazing content former Rotoworld churns out for all the players on a regular basis in Sorare today. This is not even CBS or ESPN fantasy sports, which are well behind Yahoo. Overall, the fantasy gameplay is quite barebones here.

The more compelling thing to note from Sorare is the use of NFTs. The game has two: 1) cards that are available on the ERC-721 standard and 2) potential token prizing for certain leagues. The game has a component of card packs that you open and cards that are particularly rare. As cards are played, they can level up and increase in power.

Other Games

Likely to quickly steal the throne of buzziest NFT game on the scene when it comes out, Hardcourt is the rumored title for the game Dapper Labs has publicly said it is developing on top of NBA Top Shot. Analysts expect it to be a mobile game where consumers can build NBA-like rosters to compete in online tournaments. This will be an interesting space to watch. Players could be incentivized to compete via the prizing of rare NFTs.

A few other prominent applications include Immutable X’s Gods Unchained, Alien Worlds, and Battle Pets. Other games like TerraVirtua, Battle Wave 2323, Cometh, Chainbinders ($5m funding), and TradeStars are also in development.

So, what might a future successful gaming NFT look like?

Learning from what exists on the market now, we can see the elements that are succeeding so far are selling NFTs of land and assets, like the collectibles sold on NBA Top Shot. The biggest question is can anyone turn this into a compelling game? Nearly all the “games” have promises and ideas, but we have not seen one truly executed in the same type of fun way that encourages players to play over 10 hours of a shooter PvP game, a week, for instance. Moreover, none of these are truly decentralized yet, with the ability to take NFTs from game to game. Everything right now is more or less a centralized ecosystem.

The successful gaming NFT will likely take advantage of collectible and investment aspects, while also enabling cross-game assets, and providing a compelling gameplay meta that encourages players to come back independent of the NFT, on top. What might be some interesting gameplay loops in that area?

Real Estate / Landowner Sim: Imagine being able to buy and manage land like in real life. Sometimes tenants want to break the lease. Other times, there’s maintenance to do. For decades, one city will be in a bull market, while others are in inexorable decline. It could be so fun to be rich in the sim if you cannot in real life. This genre – from Roller Coasters to Farming – has been around for gaming for decades and is proven fun.

NFT Pokemon: Imagine being the only person to own a pokemon? There is the potential for a seriously cool, real-life style, battle-hardened collectible sidekick builder. This game could easily go the way of any of the different Pokemon titles. In fact, the NFT could be the key to transferring between types. You could have your stadium fighter, but then you could port him into Pokemon go for your walk buddy, and then transfer him to your switch for mobile gameplay.

It will be interesting to see if such a successful application emerges. Does Roblox offer developers the option to integrate NFTs? Does Sea take the plunge? Or will one of Ubisoft’s bets pay off? Feel free to chime in in the comments. Maybe you think we are still in the first hump of the hype cycle and trough of disillusionment is yet to come? I am happy to discuss.

While the future for NFTs in gaming is uncertain, I, for one, think it is bright.

Learn More

Reading

- Richard Kim: Thoughts at the Intersection of Web3 and Creative Culture

- Dean Takahashi: How NFTs will change games

- The Verge: The NBA on NFT

Listening

- Modern Finance: The Sandbox with Sebastien Borget

- Deconstructor of Fun: Blockchain in Gaming with Dirk Lueth

Disclaimers: This is the very first layer of the onion. I am not a financial advisor and own all the mentioned items, as a result of reporting for this piece.