We’ve all heard the bear case on Rent The Runway ($RENT post IPO), but what about the bull case? 🐂

1: Covid Rebound Value

2: Strong Team

3: Organic Grower

So we understand, what are the most compelling parts of the bear case?

– Declining revenue

– Tough unit economics with inventory costs (clothes wear and need to be procured)

– Weak cash position is forcing IPO

So, how can the business still be worth investing in?

1: Covid Rebound Value

Although revenue and subscribers are down, that’s because the value prop is for workers who are still WFH. But these city folks are going to have to dress well again, and RTR will be there for them. It’s one of the few businesses YET to fully bounce back.

Before Covid, the business was a steady grower. We might expect it to run to those types of rates once the world returns. H1 saw 16% YoY subscriber growth, starting down the path. It’s a Value Tech Stock, IPO’ing. That’s a unique opportunity.

2: Strong Team

As a tech growth company, one of the key elements to evaluate is the team. Since the earliest days of founding the company at HBS, the team at RTR, led by Jennifer Hyman has demonstrated unusual grit, ingenuity, & innovation.

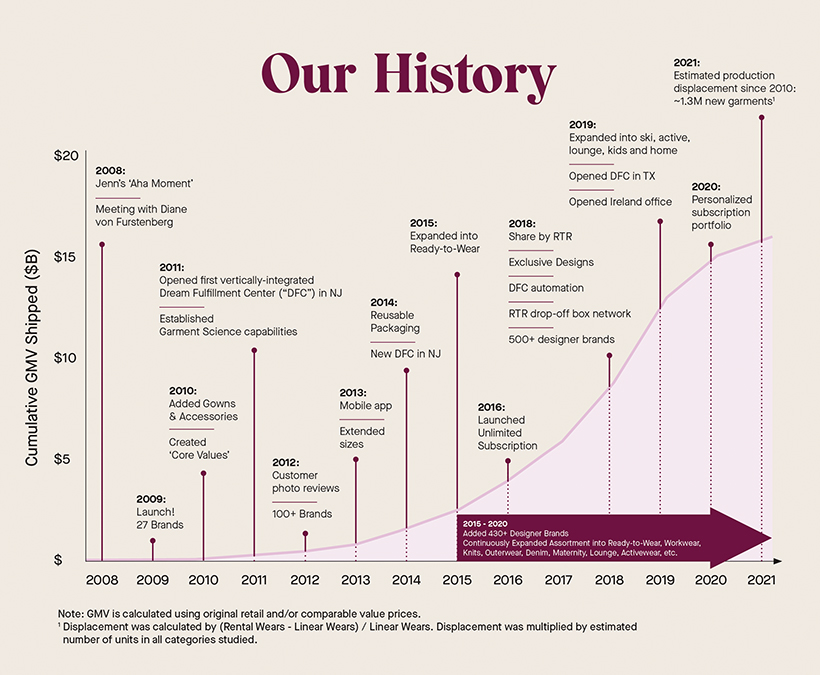

This started with Jennifer’s 2008 meeting with Diane von Furstenberg. It has extended through 2011’s launch of a vertically integrated fulfillment center, 2014’s reusable packaging, 2016’s unlimited subscription, and making it through the Covid storm in 2020. One might expect the team to continue the innovation and grit post IPO.

3: Organic Grower

The company spends remarkably little on marketing. For every dollar spent on marketing, it spends 2.7x on tech.

It is growing through two sided network effects & product. That type of growth generates improving margin profiles as the business scales.

In sum, RTR is still early – capital from the IPO could help it rebound.

The product is ahead of its time. It helps consumers be more environmentally conscious, dress better, and save money. This should help it address the bear case criticisms over time.

What do you think – would you invest?

Scott Galloway wasn’t even sure RTR will make it public, after analyzing the S-1. As someone who has been watching their product innovation for over a decade, it sure will be interesting to watch.