Overview of the key players building this thriving tech scene

Whenever I have a conversation with one of my old Bay Area friends, it goes something like this: “I have heard the Triangle is growing. But I do not know much more. What do you think about it? Who are the companies, do they have startups and successful tech companies?”

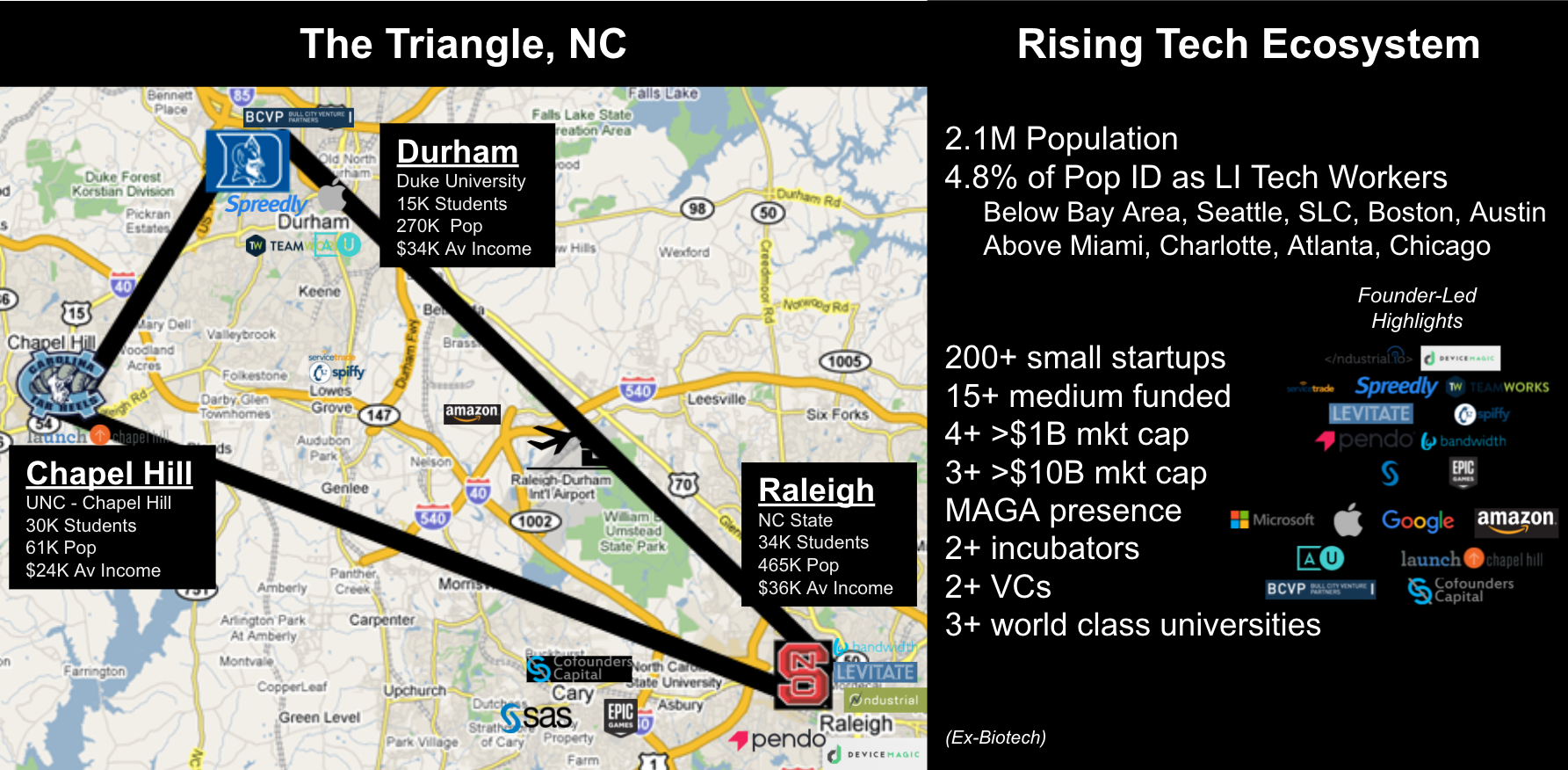

There is a bit of fog surrounding the tech scene in the Raleigh-Durham-Chapel Hill (Triangle), NC area. We have all seen the headlines. We understand it is a strong tech scene. But:

- Who are the companies?

Is there a trend, are they of a certain type or theme?

- What stage is the ecosystem?

Where does it stack up compared to more well-known names like Austin and SF?

After having lived in the area for three years, I have started to solidify my understanding of these two questions. Here are the results of my research.

Key players 🧑🏽🤝🧑🏽

Structure of a tech ecosystem

When we think about great tech ecosystems, we think about places like the Bay Area (San Francisco and Silicon Valley). We think of Sand Hill Road.

The Bay Area has every type of company – from small to large. Plus, it has a bunch of supporting functions. It has famous accelerators, like Y Combinator. It also has great universities like Stanford and Berkeley. And, of course, on Sand Hill Road, it has the largest center of technology funding in the world, Venture Capitalists. This constellation of support makes building technology companies possible.

This ecosystem is really what every “Austin is the next SF” or “Salt Lake City is rising as a tech hub” article is pointing towards. So, let’s formalize it:

A great tech ecosystem does not just come from one component. Having one great startup does not count, nor does having one large stodgy company holding headquarters in the region. There are many different components to a complete ecosystem, including: small startups, medium funded companies, large mega caps, older companies, incubators, venture capitalists, and universities

This gives us a rubric of sorts to explore where the Triangle as an ecosystem is. Let us walk through each component, to understand the story of the key players in each bucket. Then we can end with a rating against each of those components for the region. Because the area has so many founder-led companies, I will focus on those. These founder-CEOs are the stars of the ecosystem to watch out for.

Small Startups

In the area of startups (<50 employees), the Triangle has a healthy and growing ecosystem. Five particularly notable companies in the space include ndustrial.io, Device Magic, Spiffy, Adwerx, Levitate, and Service Trade. Each has an interesting story, including charismatic founding CEOs.

Industrial.io is an internet of things startup. The company has been helping factories with their energy consumption since 2011. Helmed by founder Jason Massey and COO Natalie Birdwell, the company just announced its $6M series A led by ENGIE New Ventures and Clean Energy Ventures in May. As expected, since then the company has been hiring. Headcount is up 31% in the last 6 months, to a total of 47 employees on LinkedIn.

The company is headquartered in downtown Raleigh, on Fayetteville street. Fayetteville is “Startup Alley” in the Triangle .It is a short street that connects the State Capital to the Center for Performing Arts. It is also the home to numerous festivals, like the International Festival, in downtown Raleigh.

Device Magic is a digital forms startup, founded by a pair of South African buddies, Dusan Babich and Mike Welham. Field agents have to fill out and deliver forms in areas without cell service. Device Magic’s mobile app gives those agents the tools to stay connected and digital.

The company started in another hotspot for startup activity in the triangle, the American Underground in Durham, before moving to its current location, near industrial.io in downtown Raleigh on Fayetteville street. The company has 48 employees on LinkedIn, with headcount up 23% in the last 6 months.

Although the volume is not as high as the Bay Area or other more well known areas, the overall number of quality startups, adjusted for the population, is moderately strong. For a more detailed look at the 230 triangle companies between 10 and 500 employees, Scot Wingo keeps and updates a yearly Tweener list. Buzzy companies in this category include Pryon and Lolli.

Medium, Funded Companies

The medium, funded companies (>50 employees but <$1B valuation) of the tech ecosystem is really the sweet spot for the Triangle. It vastly outperforms similar population areas in the United States. There are a number of really interesting companies in this space. Amongst the prominent are: Spiffy, Levitate, ServiceTrade, Teamworks, Spreedly, and Adwerx.

Spiffy is the fourth startup of serial entrepreneur Scot Wingo. He is considered by some the “Reid Hoffman” of the Triangle; not only has he started multiple successful companies, but he knows everyone. Scot’s first successful exit was in his 20s. He followed that up with still-public ChannelAdvisor.

Spiffy is his next venture, founded in 2014, which specializes in on-demand car cleanings. The company has seen rapid growth of cities it operates in through its franchise model. It recently opened in Cincinnati. It raised its series D round in March of 2020, having raised a total of $28.1M in funding. The company has made it through Covid wrecking demand for car servicing and is back to growing. It has 103 employees on LinkedIn, with 11% headcount growth in the last 6 months. The company headquarters are in the “Research Triangle” area of Durham, which is southeast of downtown.

Levitate is opening the category of keep-in-touch marketing software as a service. They are building marketing automation software including email personalization for insurance agents, mortgage lenders, and financial advisors. These are users who are not served by the existing automation tools. Relationships are their business, so they need specific tools to stay top of mind.

The company has 145 employees on LinkedIn with 26% headcount growth in the last 6 months. It raised an $8M series B in February, to bring its total funding to $20M. It was founded in 2017 by Jesse Lipson, one of the founders of ShareFile, which had a successful exit to Citrix in 2011. The company is right outside downtown Raleigh.

ServiceTrade builds SaaS for commercial service contractors. Like the other four companies on this list, it is still run by the man who founded it, Billy Marshall. Together with Brian Smithwick, CTO, the pair left their former employer, DunnWell, in 2012 to build SaaS for this underserved part of the market.

The company completed a $30M venture round in August of 2020. They likely benefited from the general multiple expansion that SaaS companies saw prior to that time. They compare similarly to recently IPO’d Procore, which is currently trading at 23x sales. Since then, they have been hiring, with 14% headcount growth over the last 6 months resulting in a total workforce of 132 employees on LinkedIn. The headquarters are near Spiffy in the Research Triangle area of Durham.

Teamworks builds software for teams. Every segment of the world is going to the cloud and athletic teams are no different. Colleges, professional teams, and national teams need software to effectively communicate between teammates, coaches, and staff. Teamworks enables that. It has a “who’s who” of customers, including the Tennessee Titans and Ohio State Athletic Department.

Founded by Zach Maurides, Mitch Heath, and Shaun Powell as a full time business in 2011, the team has consistently raised bigger rounds. This started with its A in 2016, B in 2018, and, most recently, its $32M series C raised in April 2020. Its offices sit in the heart of Downtown Durham, sprinkled amidst great nightlife and restaurants. In that way, it has become one of the anchor tech companies in the Triangle. The company has 117 employees on LinkedIn, with 1% headcount growth in the last 6 months.

Spreedly builds a payments orchestration solution. This enables merchants to connect to Spreedly once to get connected to payment gateways, services, and third party APIs. This helps one merchant build integrations with many providers to help with international expansion, conversion rate, and other payments goals. Their APIs make things easier for payments developers.

Founded in 2007, the company pivoted in 2012. Since then, it has been off to the races. The company raised each year between 2012 and 2016. In November 2019, it raised a $75M round. Since then, the entire payments space has seen significant tailwinds from Covid. Spreedly announced its transaction volume was up 100% YoY in Q1 2021. That growth has helped the company grow as well. Headcount is up 16% in the last 6 months to 134 employees on LinkedIn. The company’s headquarters are in downtown Durham, nestled amidst several popular bars and coffee shops.

Overall, the medium, funded company element of the Triangle tech ecosystem is robust and growing. These companies stand out as particularly successful examples. There are boatloads more. Some of the buzzier names include: ArchiveSocial, Relay, Phononic, PrecisionHawk, Validic, Adwerx. JupiterOne, Well, FlexGen, K4Connect, Zaloni, and Second Nature. And that’s even before you get to the billion dollar companies.

$1B+

In the area of medium-size technology companies, there is a special class of companies with >$1B valuation & <$10B valuation. The Triangle also has a few of these companies. Two that are particularly buzzy are Pendo and Bandwidth.

Pendo builds software for product managers and product teams. It is the latest in line of many successful enterprise software startups from founder Todd Olson. As a VP of product at Rally Software from 2011 to 2013, Todd was frustrated by the data he was getting on products. He wanted event data on every click, going back historically, collected without instrumenting each and every action. In 2013, Todd did not see software in the market out there to solve that problem. So, he built it himself, even coding the initial versions.

Fast forward to today, and Pendo is a Unicorn. The company has over 800 employees, with a tremendous 40% headcount growth over the last 6 months. It most recently raised its series F at a $2.6B enterprise valuation in July 2021. It has had a prodigious funding history, with a total of $360M raised. The company is one of the anchors of the tech scene in downtown Raleigh, on Startup Alley, Fayetteville street, along with industrial.io and Device Magic.

Bandwidth is an enterprise communications company. Their cloud platform helps enterprises with voice, messaging, and emergency services. Founded in 1999, they have had the time in industry to become a national operator in 30 countries. They use that capability to help companies navigate global regulations and telecomplexities. The company has a variety of APIs to allow companies to easily embed voice calling, text messaging, and emergency services into their software.

The company IPO’d in November 2017 and its market cap has 3x’d since. The company is now worth $2.2B. It continues to grow quickly. In the first half of 2021, it grew its revenue at 61% year over year. The company has over 1,100 employees on LinkedIn, with 6% headcount growth over the last 6 months. The company is located besides North Carolina State University in downtown Raleigh.

Other $1B+ companies in the Triangle include insightsoftware (founded in 1993) and Wolfspeed (founded in 1987). Both are tremendous companies, though neither founder-led.

Transplants

In addition to the home-grown companies, the Triangle also features a strong presence from transplants. Driving through Durham, the logos of PolicyGenius and Avalara are unmistakable.

PolicyGenius is an InsurTech company, specializing in helping customers sign up for life insurance over the phone or online instead of in person. They recently raised a $100M round from KKR, the PE firm, in January 2020. Rumour has it they are set to SPAC. They write on their careers page that Durham is their second headquarters outside of NYC. They have 206 employees in the Triangle, per LinkedIn.

Avalara builds tax software for companies. To public market investors the name will be familiar. It has had a tremendous 3x appreciation since its June 2018 IPO. The company now has a market cap of $15B. They employ over 500 people in the Triangle, per LinkedIn.

Other transplants have come to the market for great talent as well. Climavision, for instance, just raised a $100M round, and expects Raleigh to play a key role in its plants.

Large Mega Caps

When it comes to mega-caps, Seattle and SF have a different perspective than the rest of the world. SF and Seattle have trillion dollar companies, with multiple hundred billion dollar companies aplenty. While the Triangle and the rest of the world are not there yet, the Triangle does boast multiple decacorns worth >$10b. Two of the most notable founder-led examples are Epic Games and SAS.

Epic Games is a gaming industry disrupter. At every level of the video game value chain, Epic has a top 2 product. The stack can be considered: development, distribution, and games (or applications in a traditional parlance). Starting with development, Unreal Engine is the undisputed number one choice for the top game teams (known as AAA). On the distribution side, the Epic Games Store is the #2 PC games store. Finally, within games, as the public learned in the Apple case, Fortnite made over $5B in a year. That is the biggest single-year haul of any game ever.

The company was founded in 1991. Having been around for 30 years, it has established icon status within the gaming industry. It employs over 5,700 people, per LinkedIn. And it is not stopping growth. The company has raised over $1B rounds in both 2020 and 2021. Naturally, then, headcount growth was 12% in the last 6 months. Recently, the company bought out an entire shopping center to build its new headquarters.

Both Epic Games and SAS are in Cary, NC. Thanks to these two behemoths, Cary is the highest income part of the Triangle, with over $100K average household income. It is 10 minutes drive east of Raleigh, so somewhat towards Chapel Hill and Durham, the other legs of the Triangle. Cary is to the Triangle as Palo Alto is to the Bay Area. It is not Oakland, San Jose, or San Francisco; it is the rich, important enclave in between.

Not to be confused with the airline, SAS is an analytics company. Its SAS software dominates the old-school enterprise market, with over 70,000 clients. Many of these remain on-premises deployments. It is a great steward to those highly data secretive companies like financial services and governments. For newer companies, SAS has also re-architected its main product lines to the cloud.

Founded in 1976 by Jim Goodnight, he is remarkably still the founder to this day. The company employs a tremendous 22K people, with 1% headcount growth over the last 6 months. Bloomberg recently reported that SAS generated $3B in revenue in 2020. Rumors in July were that Broadcom may buy it for $15-20B.

The other famous software decacorn in the area is Red Hat, although Red Hat was purchased by IBM for $34 billion in 2019, the Red Hat logo still flies high over Raleigh’s downtown. It employs over 2,700 people in the Triangle, per LinkedIn.

Older Companies

Until a few decades ago, older technology companies were the Triangle’s strong suit in technology. Those companies deserve credit for generating, training, and funding much of the talent that has since created other companies. They are spread throughout the area.

If you drive through the Research Triangle Park area between Durham and Morrisville, you will see legions of companies that were around before the dot com crash. Four prominent public names are IBM, Cisco, NetApp, and Lenovo. IBM and Cisco each employ over 7,000 people in the Triangle. Lenovo employs over 3,000. NetApp employs over 1,600.

Downtown Raleigh, it is hard to miss the big Citrix building. Citrix employs over 650 people in the Triangle.

MAGA

You cannot talk about mega-caps without talking about trillion dollar companies: Microsoft Amazon, Google, and Apple all have a presence in the Triangle.

Microsoft and Amazon each already employ over 1,000 people in the area. Microsoft is amidst the office parks of the Research Triangle Park, with the other older companies. It has over 1,000 employees in the Triangle, primarily in cloud sales and GitHub. The company took advantage of tax incentives to add 500 jobs over the last two years. Amazon has 1,900 employees in the Triangle, primarily in AWS and e-commerce operations. Its massive RDU5 fulfilment center is by the airport.

Google and Apple have smaller but growing footprints. Google already employs over 400 people in the area. It announced it will be adding 1,000 more jobs, as it is making the area an engineering hub. Apple already employs over 500 people in the area. It also announced in April that is building a $1B campus in the area. It expects to bring over 3,000 jobs to the area, paying more than $187K on average.

Incubators

The Bay Area has Y Combinator. The Triangle, too, has accelerators. Two that stand out are the American Underground and Launch Chapel Hill.

In the 11 years since the American Underground’s founding in 2010, many of Durham’s successful startups have worked in the space. It is primarily known for its coworking space, which is placed right at the center of Durham’s downtown. The underground is one of the hubs of the startup community in downtown Durham. It helps startup employees meet others in the same boat. ArchiveSocial, an alumni, has raised over $55M in capital and has over 100 employees. Kevel, formerly known as Adzerk, is another successful alumni in the area, with 73 employees.

Currently 39 companies have listed jobs on their job board. This includes interesting companies like Upswing, a solution to reach non-traditional learners, and Nugget, a kids furniture company. It is the type of place where web3 and DAO meetups happen. The space has contributed to over 3,000 jobs in its first decade, and we can expect many more in its second.

Launch Chapel Hill was founded in 2013. It is known for its coworking space and twice-yearly accelerator program. Its accelerator runs 16 weeks. Over 15 cohorts have been run now, so a variety of companies have seen success. Alumni include Spiffy, profiled above, WalletFi, a subscription management solution for FinTechs, and local bagel stalwart Brandwein’s Bagels (get there early!).

Other incubator-like programs in the area include the Riot Accelerator Program, . A number of the successful startups in the area have spent time at one of these spaces. They create learning and teaching communities that were watering holes for business creativity, at least pre-covid.

Venture Capitalists

There are a number of venture capital firms investing in Triangle area companies. Two that stand out as particularly active in the community are Bull City Venture Partners and Cofounders Capital.

Founded in 2013 by David Jones and Jason Caplain, Bull City Venture Partners has raised several successful funds and been involved with many of the most successful tech companies in the area, including ChannelAdvisor, etix, motricity, Spoonflower, VividCortex, and WeddingWire. The current portfolio includes several local companies profiled above including Levitate, Spiffy, and ServiceTrade.

Founded in 2015 by David Gardner, Counders Capital started with a $12M fund. In 2019 it raised its second fund, a $31M vehicle, which the company is on the “tail end” of. It has invested in a number of the area’s notable companies, including Tribucha and RelayOne. David is a regular contributor to all of the area’s tech media.

Other venture firms operating in the area include Pappas Capital, Morgan Creek Capital, SJF Ventures, Harbright Ventures, Idea Fund Partners, and Hatteras Venture Partners.

Of course, outside venture capital firms also invest in Triangle area companies. In total, they have invested over $2.2B in the area in the first three quarters of 2021.

Universities

The ace in the hat for the triangle area is its universities. It does not just have a rich ecosystem of existing tech players. It also has a rich factory for molding smart tech talent.

Between the three schools, the area hosts 80K students. Duke is a top 10 school perennially on the US News & World Report’s national universities rankings. UNC Chapel Hill ranks 28th on that list. NC State has one of the top 15 engineering colleges in the country, with over 10,000 students.

The universities act like innovation hubs. UNC, for instance, plays a big role in supporting Launch Chapel Hill. NC State is affiliated with Bandwidth. The great thing about universities is they are much more resistant to recessions as well. This allows the area to thrive in times where NYC or SF may be experiencing a downturn.

Special mention: Biotech

This article has only focused on the pure tech / software side of things. The Triangle also has a thriving biotech scene. It has large public companies, like Biogen. The large companies and universities feed a thriving startup scene. When you drive around Durham, you see Lamborghinis and Ferraris at the worksites of companies like recently IPO’d Precision Biosciences. If you peruse fundraising lists, you will also find companies like Well, who raised a $40M series A in December of 2020. Stride Bio is one of the hottest gene therapy names. And the list goes on… This article has focused on software.

Stage of the Ecosystem 🌊

Waves of Innovation

One of the reasons having all the components is important is that technology ecosystems develop in waves. The Triangle has seen its fair share of waves as well. Each wave, like all other growing ecosystems, has grown bigger each time.

The old companies feed the new, especially startups. ShareFile beame Levitate. ChannelAdvisor, Spiffy. These things come in waves. This is what makes the system very similar to SLC, Seattle, SF, or any environment. Those are just further along in the cycle when it comes to waves. But the Triangle has proven its ability to create the waves of success, and it is destined down their path.

Comparison

So, the question is, where does the Triangle rank compared to others? It is tough to say. One approximation we can use is the population of an area, and the number of people identifying as working in tech on LinkedIn. This gives a percentage of the population identifying as working in tech. It is a density metric. It adjusts for population. When you run the numbers on this, the rankings match my intuition:

The Triangle comes in as the sixth most techie area, pound for pound. This seems right. With all the companies I documented above, as a proportion of its population, it has pushed ahead of other areas like Atlanta, New York City, Charlotte, Chicago, Detroit, and Miami. The Triangle has a fairly high density of techies.

On the other hand, the big headline tech areas are still rank ahead of the Triangle. The Bay Area is on top, expected. After that comes Seattle, then Salt Lake, then Boston, followed finally by Austin. These rankings “feel right.”

Conclusion ↗️

America is a hub for innovation. Its universities draw the best. It churns out the most research by impact factor. The Triangle is a beneficiary of three great universities. This has spawned amazing companies in early waves, like SAS. It has supported waves of workers at scores of companies including players like IBM.

Now, the ecosystem is robust, with companies and institutions at each layer. Where the Bay Area has Sand Hill road, the Triangle has Fayetteville Street. Where the Bay Area has Palo Alto, the triangle has Cary. Where the Bay Area has Reed Hastings, the Triangle has Scot Wingo. Where the Bay Area has scores of founder-led companies, so does the Triangle.

When you put the rankings together, RDU is a few years behind Austin, Salt Lake City, and Boston, but it is well on its way to being one of the next big hubs, along with its sister city Charlotte, and many other cities like them: Miami, Atlanta, and Detroit.

If you are looking for more information on the area, it actually also has a rich media ecosystem. The Grepbeat operates a wonderful newsletter on tech companies in the area. The WRAL Techwire and Triangle Business Journal also do an amazing job covering the companies in the area.

Here, at Product Growth, in future editions we will deep-dive into the product growth strategies of these companies. Who do you want to learn about first?

Note: These are just the companies in the ecosystem I have gotten to know. I have spoken with more than 3 employees at all of the above companies. There are many others I have not done that with.

Reminder: none of this work represents my employer or former employers. I used to work for Epic Games.