This one-time dorm room startup is now set to IPO for over $1B. And it’s not a software company! What do you need to know about $SG now that the Sweetgreen S-1 has dropped?

Learn the amazing story of this salad chain, which gets 68% of its revenue from digital channels.

The Founding Story

In 2007, three students (Nicolas Jammet, Nathaniel Ru, & Jonathan Neman) simply wanted a healthier way to eat. The options were food that was fast, cheap, and unhealthy or slow, expensive, and healthy. Enter the idea for sweetgreen: fast, cheap, and healthy.

Unlike most Georgetown students, who go on to lucrative Wall Street jobs or grad school, the three cofounders committed to work on the idea after graduation.

A salad startup! Not a tech company. This was very bold. Two months later, they opened their first story near campus:

The idea stuck. Customers loved it. They have an insane NPS of 78.

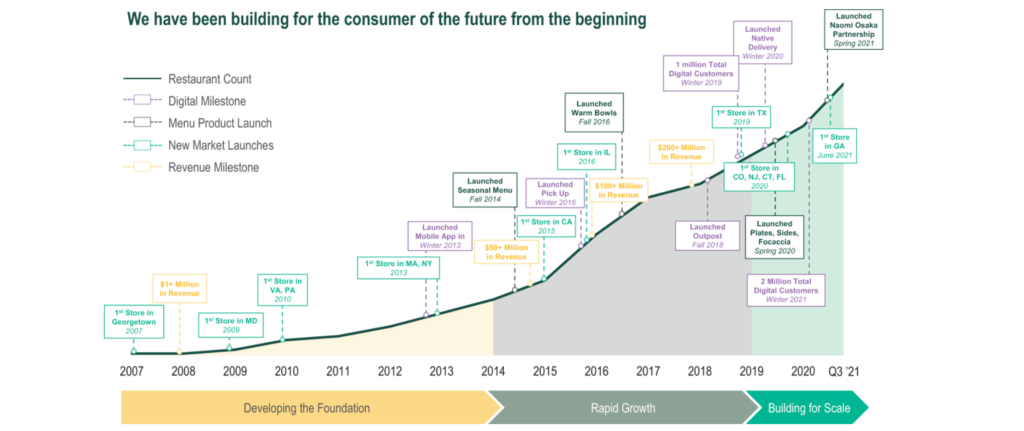

Since then, the company has been on a relentless sprint to spread its mission. The team has been opening new stores and growing the Sweetgreen brand.

One of the company’s key techniques to making each individual store succeed is: scaling intimacy. Nathaniel Ru calls this intimacy at scale. They make each Sweetgreen “feel like YOUR sweetgreen not just A sweetgreen.”

Sweetgreen wasn’t the first salad concept, but it was first to cultivate loyalty in its audience outside the restaurant. The Sweetlife music festival kicked off in 2011 with the Strokes. In subsequent years, artists like Lana Del Rey & the Weeknd have generated tons of noise.

Sports too. When the world started to question Naomi Osaka for not talking to the media, Sweetgreen went the other way. SG zigs when others zag to do the right thing. They signed Naomi Osaka as a brand partner.

The company has deliberately built a purpose-driven brand.

Store launch after store launch, the team has now grown the footprint to 140. The company is helping a generation re-imagine fast food to be healthy. So, how do the numbers look?

The S-1 Analysis

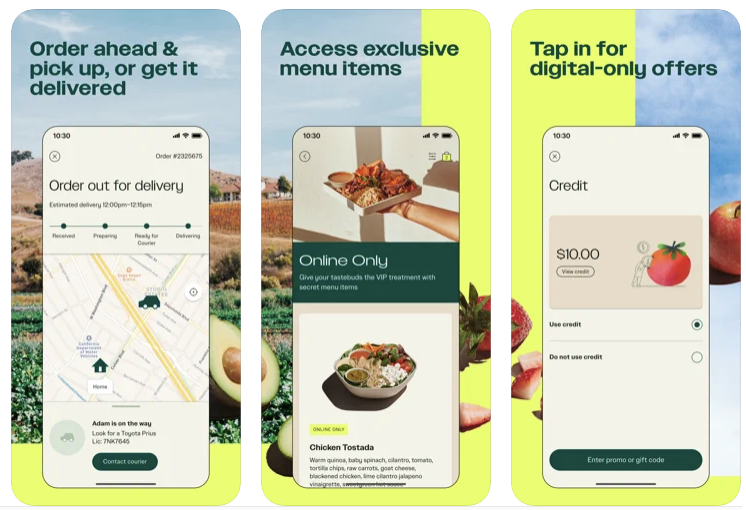

Let’s start with how it gets to that crazy number of 68% of revenue via digital channels: 47% comes through their owned sites, and 21% comes from delivery partners.

In other words, they have a widely used, sticky app.

The app and digital revenue are key – because they give Sweetgreen a more growthy-tech style multiple.

Starbucks and Chipotle are the types comparables the company hopes for.

- $SBUX: 5x EV/ Next FY Revenue

- $CMG 6.4 EV/ Next FY Revenue

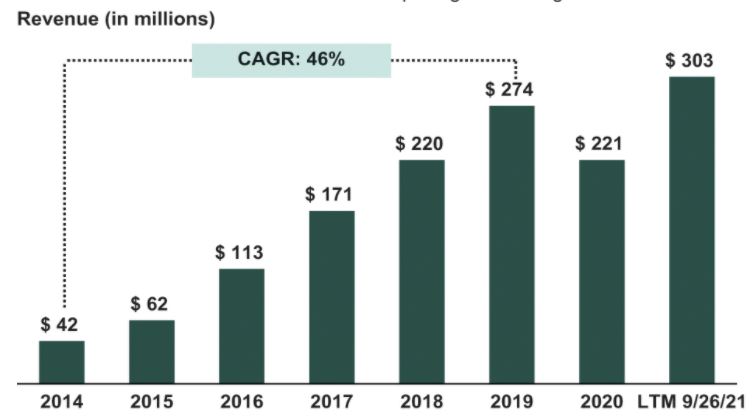

If we estimate $380M next FY revenue for Sweetgreen, 5x gives it roughly a $1.9-$2.4B valuation.

The expected range for the business is actually lower. Why? The company is not profitable at all. It is burning cash. Chipotle and Starbucks mint it.

So, the question is, does the company have a path to profitability?

The executives point to stores having year 2 cash-on-cash returns of 42-52%. The bet is economies of scale will enable consistent restaurant level-profit margins of 18-20% (already 12%).

Should you invest?

What is the bear case?

- NYC drives 1/3rd of revenue: heavily dependent on return to office

- Focus on restaurant-level profit obscures the overall lack of profitability and expensive way of growth

- This is a restaurant chain, not a tech company

What is the bull case?

- This is a proven management team through thick and thin, growing at 46% CAGR pre-Covid

- It plans to open new markets and build more stores, creating plenty of runway for growth

- Economies of scale will enable cash flow & profitability in the future

It is up to you to decide from here. Will you be investing in the IPO?

Sources: TechCrunch, Washington Post, Georgtown, Eater