In 2012, Tim Brown retired after 6 years as a professional soccer player. Today, his company IPOs for over $2B. What a story. Stick around for an IPO valuation analysis at the end.

The Allbirds Story

Post retirement, Tim went to the LSE.

Then he met his co-founder. Joey Zwillinger had graduated from Wharton MBA and was working in sustainable materials. He wanted to launch a shoe company.

They started a Kickstarter, hoping to raise 30K. In four days, they raised $120K:

In 2015, Allbirds was officially incorporated. The duo aimed to create a different kind of company, that would reverse climate change. They established the company’s mission as “better things in a better way.”

In 2016, Allbirds became a B Corp. Also in 2016, Time Magazine called Allbirds “the world’s most comfortable shoes.” Allbirds sold a million pairs in its first two years as a result.

Allbirds is not a shoe brand. It is a lifestyle brand plus a sustainable materials brand. They have pioneered use of tree fiber, sugarcane, crab shells, and more. Their shoes use approximately 30% lower carbon than a standard pair of sneakers.

In 2018, Allbirds became a unicorn. It also pioneered a carbon-negative green EVA made with Brazilian sugarcane, as an alternative to traditional EVA made from petroleum. They use this carbon-negative green EVA to create SweetFoam, which is now in all of their shoe soles.

They were on the right side of history.

- >60% of consumers state that environmental impact is an important factor in their purchasing decisions (2020 McKinsey study).

- > 80% of consumers insist that they must be able to “trust the brand to do what is right” (2019 Edelman study).

Fast forward to today, and fashion icons including Sarah Jessica Parker, Mila Kunis and Jennifer Garner have all been seen wearing the $95 eco-friendly shoes, made of natural materials such as wool and sugarcane that let customers “walk on a cloud.”

The company operates 27 Stores. They call it an “early phase of a ramp towards hundreds of potential locations.” But the digital channel still represented 89% of sales in the latest quarter.

Allbirds just launched a new R&R collection, which features loungewear for men. This fits with their stated vision: “We want them to be the uniform of every day, very utilitarian.”

Drivers of Success

How has Allbirds has been successful so far? 5 ways.

1. Product Innovation Based on Materials R&D and Simple, Purposeful Design

They have consistently launched products relying on materials from nature.

2. Purpose-Driven Lifestyle Brand with an Inspirational Voice

The brand inspires consumers to live life in better balance, which creates affinity and loyalty with their growing base of customers.

3. Deep Connection with Customers

- Allbirds has more than two million people on their email list.

- NPS was 86 for the first half of 2021.

- Approximately 53% of our net sales in 2020 came from repeat customers.

4. Global Vertical Retail Distribution Strategy that Melds Digital with Physical

Allbirds has direct distribution to customers in 35 countries and across 27 store locations allowing them to effectively manage inventory, while also realizing better margins.

5. Unique and Agile Infrastructure with Key Investments in Place to Scale

Allbirds inventory can go from purchase order to ex-factory in as little as 45 days. They have 9 distribution centers across 8 countries, allowing them to reach up to 2.5 billion people across 35 countries.

IPO Analysis

Tomorrow, Allbirds becomes $BIRD The valuation will be about $2.2B. They have a unique niche, sustainable apparel. But how do the numbers look?

Metrics

The three key numbers are:

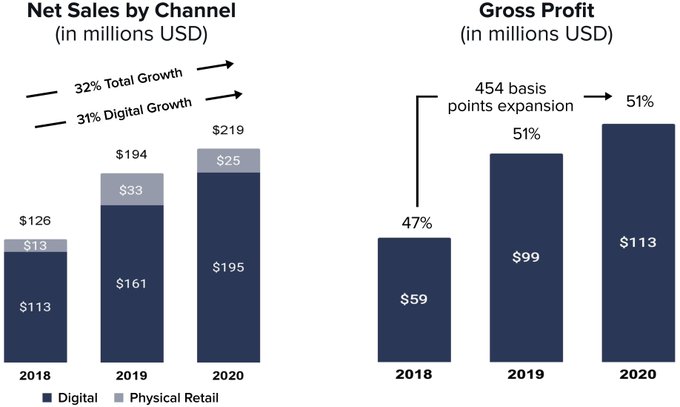

- Revenue grew 32% CAGR last 2 years

- Net losses increased in the same time frame

- The company has yet to turn a profit, but improved gross margin to 51%

IE, a 9x EV / FY 21 Sales ratio as a moderate grower that is not profitable.

The second layer of metrics are mixed.

- BEARISH: Revenue from new customers declined year-over-year in 2020

- BULLISH: 100% of all cohorts have contribution profits in excess of CAC within the initial month of purchase

Valuation

How do its Direct to Consumer Comps look?

EV / FY 20 Rev | Rev YoY % Growth

- On: 26x | 59%

- FIGS: 21x | 139%

- Warby Parker: 14x | 6%

- Allbirds: 10x | 32%

- Honest Company: 2.5x | 29%

- Casper: 0.3x | 23%

So it’s middle of the pack. Valuation seems reasonable, but could go up or down. It depends on execution.

Final Words

Incumbent footwear and apparel brands compete with performance-focused products. They reverse-engineer sustainability into their products They are constrained by synthetic, off-the-shelf materials, entrenched supply chains, and compressed margins via wholesale distribution.

So the ultimate bull case is that Allbirds will deliver on its vision: “People don’t buy sustainable products. They buy great ones.”

Note: My version of reality is based on a private talk Joey Zelwinger gave to me and a group of friends. He is a Wharton MBA alumnus, where I got my MBA. I know public news sources have some of the sequences at the beginning different. I am presenting the reality from my reporting.

Disclaimer: This is not investment advice and does not reflect my employer. This is just my years of research compiled into a short piece.