Six months ago, OpenSea raised at a $1.5B valuation. Today, it just raised at a $13.3B valuation.

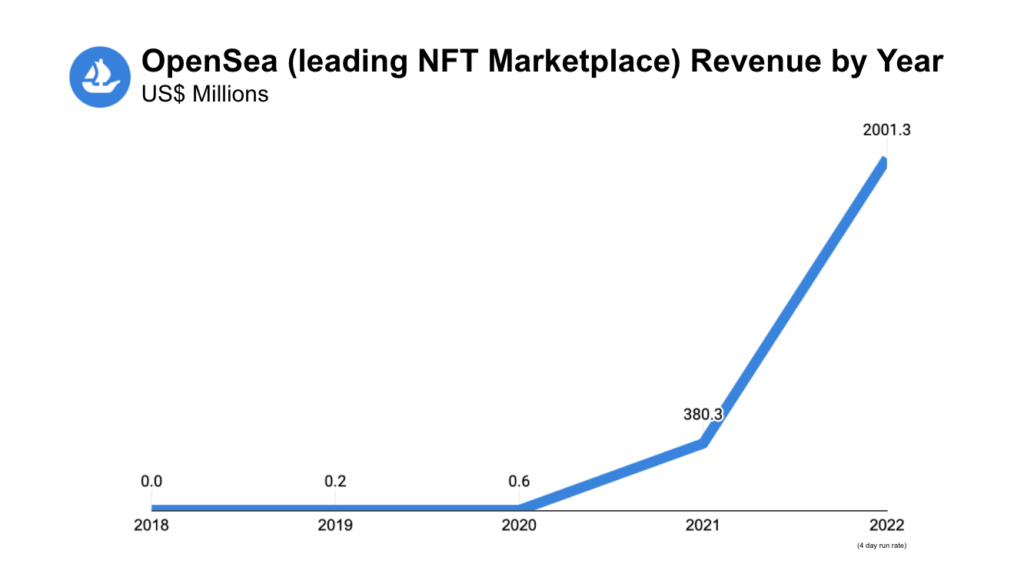

NFTs are a massive business. Here is OpenSea’s yearly transaction volume. It takes 2.5% of that volume, generating the revenue in the pictured line chart.

2018: $474K

2019: $8M

2020: $24M

2021: $15B

We’re only a few days into 2022, but OpenSea did $900 million in its first 4 days. That puts them on pace for over $80B in transaction volume in 2022.

This is a massive business. OpenSea managed to have the same Gross Merchandise Volume (GMV) as Etsy in 2021.

But, in comparison to Etsy, OpenSea boasts a 97% market share 🤯

That is insane market share. The big tech players are not that dominant:

▫️ Google holds a 92% market share in search

▫️ Facebook and its associated properties boast more than 3x the active users as its next competitor

▫️ Amazon’s domestic e-commerce dominance is pegged at 50%

The easy thing to do is write off NFTs as a ponzi scheme.

The smart thing to do is double click on what these are and the innovation they enable. “Dumb money” does not generate businesses like OpenSea’s.

NFTs are units of data that cannot be changed. People buy them for status, scarcity, and belonging. NFTs grant clout, showcase your personality, and give you access to private groups.

The communities around them are speedrunning experiments in web3 to figure out the best use cases for blockchain.

Protocols like ERC-721, created by CryptoKitties in 2017, have changed the world forever. It would probably make sense to start paying attention.

Projects like Axie Infinity, Crypto Punks, NBA Top Shot, and Bored Ape Yacht Club are set to change the world. And they’re all bought and sold on Opensea. It’s an amazing business.

The product team has continuously innovated, with permission listing, asset breadth, and robust filtering. Now, they are seeing the fruits of their labor.

In a few years, Devin Finzer will be taking the company public at a triple-digit billion dollar valuation.