From the New York Times and Wired to Allure and Vox, everyone seems to be writing about digital fashion. For gamers like myself and our collaborators for the week at Master the Meta, this is a bit of a head-scratcher. Cosmetics have existed in games for over 20 years.

So, the question of the day is: What is digital fashion, and is it any different from the in-game cosmetics games have had forever? There’s no one better than Fawzi Itani for us to dive into it with.

Let’s begin with the definition. A good one is by the NFT and art collective Dissrup:

Digital fashion is the culture surrounding the designing, collecting, and wearing of garments in the digital realm.

This is the crux of the change – while video games have always been the foundation of digital fashion, in the past six years digital fashion has rapidly evolved beyond in-game cosmetics. The culture and industry in and around fashion have collided with the digital world.

The key difference is the direction of interest has flipped. Whereas before gaming companies would set out to make buzzy partnerships to leverage the pull of the offline brands, today luxury fashion brands are turning to games to attract new buyers. This is not just Gucci teaming up with 100 Thieves. Vogue is calling gaming, “Fashion’s new playground.”

Consider photographs. Companies like DressX have sprung up to solely market fashion that appears in retouched photographs. You purchase the dress on the blockchain, and it comes back on your image:

Fashion has now bled from pixels into the real world. Digital pixels are purchased to enhance our real physical avatars. In addition, with all the buzz about the metaverse, more and more non-gamers are entering digital worlds to purchase pixels to dress their digital avatars.

These two trends have major implications for the gaming market.

For the case of digital pixels dressing real avatars, it is only a matter of time before the same assets used for gaming cosmetics are applied to actual people. Imagine a tool to take your Fortnite skins and visualize them on a photo of yourself, a la DressX. This suddenly makes those skins much more valuable. DressX dresses go for $35+. Fortnite skins go for $3+. The assets could be worth an order of magnitude more than they are today.

For the case of pixels to dress digital avatars, the inroads gaming has made over the past 20+ years look to be only the beginning. We are now witnessing an exponential rise in collaborations between fashion brands and games. This is bound to continue. In the future, Jordan brand’s big drops will not just occur in the real world. They will simultaneously launch in games, with similar fanfare and prices.

As a result, the rise of digital fashion looks set to multiply the total addressable market for in-metaverse and out-of-metaverse fashion assets. Let’s go one layer deeper.

Digital Pixels in the Real World

Part 1 – Why they matter more than ever

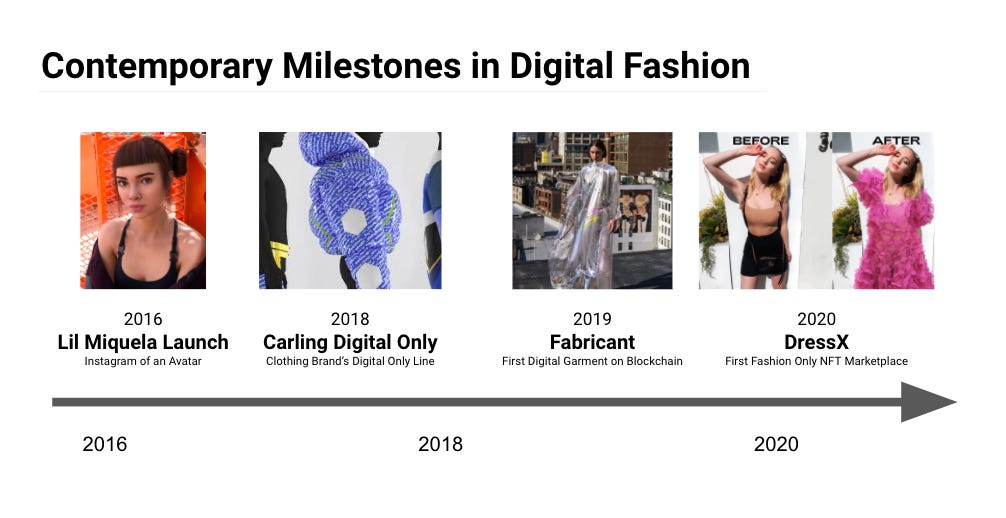

In the past five years, digital fashion has exploded onto the scene. Four events in particular have changed the landscape. The first was the launch of Lil Miquela in 2016. Since her launch to today, she has managed to amass over 3M followers. Not bad for a digital avatar. She set off a wave of interest in digital fashion in the broader fashion world.

Then, in 2018, the Scandanavian fashion house Carling released a digital only line. It hit all the major fashion publications and created even more buzz for the digital fashion category.

In the post-covid, increasingly remote world, AR-style digital enhancement of our physical selves become much more attractive much more quickly. From our friends to our colleagues, we increasingly interact through a screen. As a result, paid-for digital enhancements increasingly make sense.

One can imagine a world soon where the Zoom marketplace sells the whole range of enhancements, from professional attire so you can zoom in a t-shirt to buzzy dresses so you can join happy hour with a bang. It’s not far off in a world where the makeup giant L’Oreal is 1.5 years removed from its first digital makeup line.

Besides our increasingly digital interfaces post Covid, another factor driving digital fashion has been NFTs. NFTs got their start in 2019 with Fabricant, which registered the Irridiscence dress on the blockchain. Today, leading digital fashion influencers like Stephanie Fung generally get to share in a cut of the proceeds by making the pieces tradable on the blockchain. stephyfungA post shared by Stephy Fung (@stephyfung)

The vast sums of money being made in the NFT market – Opensea had the same GMV as Etsy in 2021 – have contributed to the acceleration of digital pixels in the real world. Now, a future of users queuing outside a real store for a new digital NFT drop does not seem far away. It is the Supreme strategy applied to games.

This was particularly enabled by the launch of DressX, which we covered in the intro, in 2020. It was the first NFT marketplace dedicated to digital fashion.

But outside of crypto-first companies like DressX and Fabricant, the real hook for big fashion brands like Carling to move into this market of digital fashion is that making a handbag digitally is much cheaper than physically. Plus, the economics scale better after the initial fixed cost is recovered. This is propelling forward the market for digital fashion from a brand-first point of view.

Part 2 – What this means for gaming

Astute gaming companies will be first to market with assets that can be transposed outside of their game via blockchains. This will enable a Fendi collaboration to last beyond the game for the player.

Games like Glu Mobile’s Covet Fashion seem ideally poised to make such a transition. But now that Glu sits in EA under Microsoft, the question is: would they make such a strategic change in focus towards digital pixels in the real world? The same goes for Fashion Famous on Roblox.

While it may be unlikely for cash cow games like Covet Fashion or Fashion Famous, gaming companies are taking other inroads. Already, companies like Epic Games are releasing promotional videos and courses to support the use of their gaming engine, Unreal, to fashion use cases. One could easily imagine the Unreal engine designed Fendi dress that was made for a Television ad appearing in the next Fortnite concert.

These will likely be the early inroads for gaming into the true world of fashion, providing the enabling technology for those creators. Games, on their own, do not seem set to be the only setting for digital fashion shows. Instead, that setting is an entirely different category of digital fashion.

Digital Pixels for Digital Avatars

Part 1 – Why they matter more than ever

Cosmetic microtransactions have been a staple of gaming monetization since the early 2000s. But since the onset of the Covid-19 pandemic, the collaborations with offline brands have multiplied. From skin-care brands like Tatcha partnering with Animal Crossing to high fashion brands like Louis Vuitton collaborating with League of Legends, everyone is getting in on the action.

Beyond Covid, two events have significantly contributed to the increased importance of digital fashion.

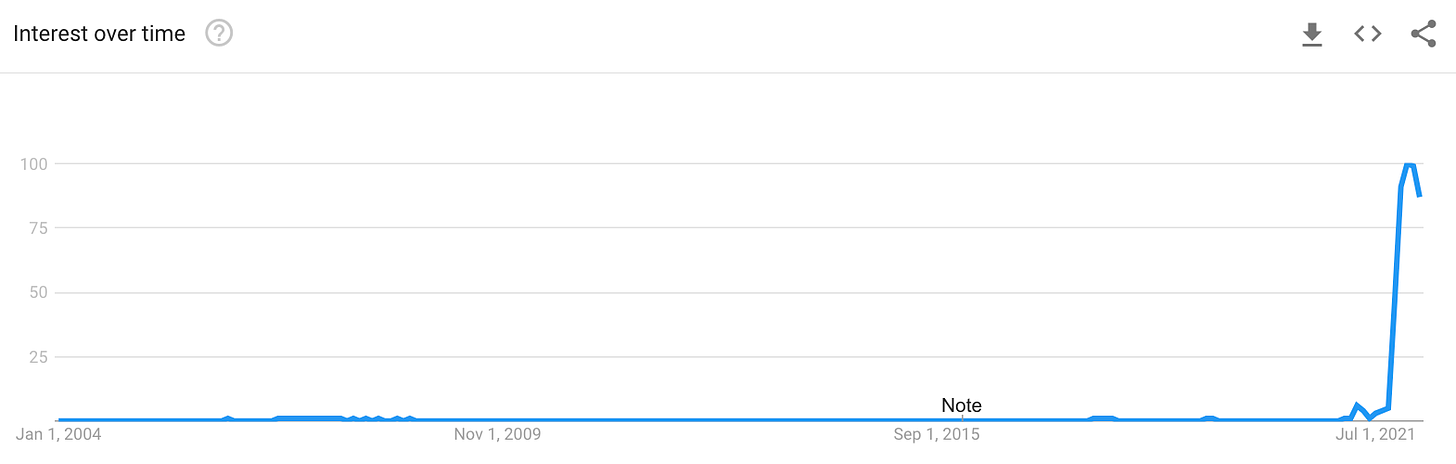

First, Facebook’s change of name to Meta has also led to a dramatic uptick for interest in the metaverse. Google search interest for the term has spiked from 0 to 100.

This has led to an uptick of interest in digital avatars. When viewing Mark’s vision for a telecommuting world of extended presence with VR-embodiments of ourselves, billions of Facebook’s users around the world couldn’t help but ask: how am I going to look in the metaverse? As Matthew Ball predicted, the metaverse is likely to lead to the emergence of new Metaverse-first fashion houses.

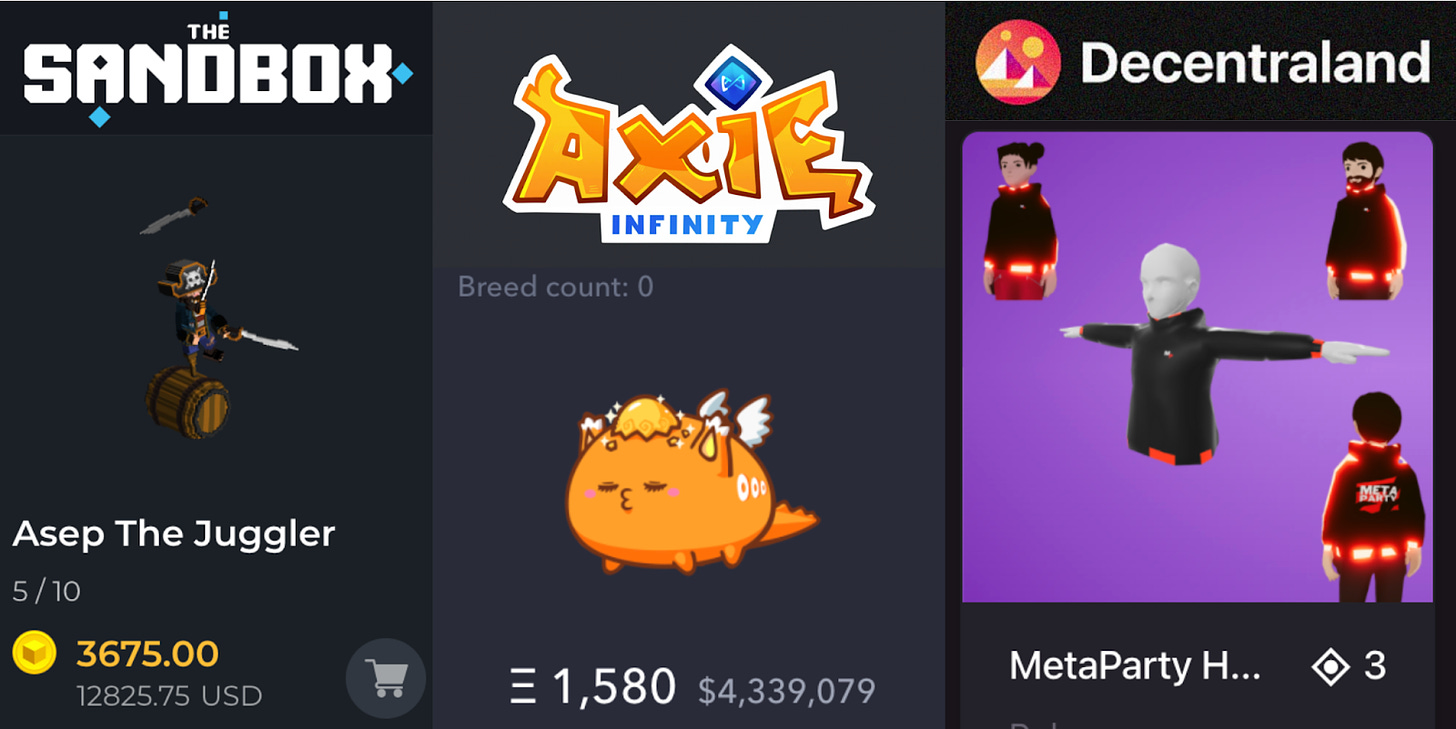

Second, the 2020 swoon in the price of blockchain-based digital avatar games has propelled forward interest in crypto-based digital fashion. The Sandbox, Axie Infinity, and Decentraland were 3 of the top 10 performing cryptocurrencies of the year. All 3 feature avatars and cosmetics players can purchase and trade at high-dollar real money amounts.

Part 2 – What this means for gaming

It remains to be seen if any native gaming companies will venture into the realms of uncapped priced, freely tradable and portable assets that these blockchain-native games have. There appears to be significant money in it for those who do decide to. Many NFT assets sell with 5% of the traded value going to the original creator.

This could become a dramatic, new monetization model for a blockchain-forward gaming company like Ubisoft, which is also trading near its 52-week low. The current plan for Ubisoft’s Quartz initiative is to wrap in-game cosmetics from Ghost Recon into NFTs. If this is executed well, it could be a model for other incumbent video game developers.

But, even if gaming companies do not go the blockchain route, the growing interest of the fashion world in second life type spaces shows the ongoing interest of digital avatars and cosmetics. Gaming collaborations with fashion brands are set to be more frequent and bigger to come.

Places like the Steam Marketplace for CS:Go have allowed player trading of cosmetics for agreed upon prices for over a decade. Those markets too have seen strong growth in value. The median price of the weapon case one has increased 50x from $1 in 2013 to $50 recently.

The rise of digital fashion makes it possible that this price growth is only the beginning for permanently on franchises like League of Legends, Fortnite, and Counterstrike. Of course, of those three, only Counterstrike has a secondary market. Both Riot and Epic seem unlikely to introduce a secondary market for trading. That leaves the market more open for new entrants.

Just how large can such a market be? Estimates for CS:GO’s market sit at around $1 billion in trades per year. At its peak in 2015, Second Life had a GDP of $500M. As Vice said, “It was never just a game.”

Building a game with decade plus engagement is much easier when users build their businesses in the game. Suddenly, the platform becomes sticky. It moves from a game to something more akin to eBay or AirBnb, with users actively using the platform to support their off-platform activities.

Creator-led economies of user-generated content, like Second World but unlike CS:GO, have particular stickiness. They allow creators to express themselves artistically. This then enables a longer tail of creators who don’t make enough to support themselves to also exist in the platforms.

Of course, these systems have real disadvantages that make them untenable for first party studios under mega-brands like Microsoft and Sony. The first disadvantage to these systems is that, without regulation, there’s tons of ridiculous Nazi and sex stuff in the marketplaces.

To go big in a mainstream way, the platforms will need to be able to build Roblox-like chat filtering technology that works reliably enough for parents to trust their children to play them. Whether such a thing can be built and willingly undertook by a major gaming company remains to be seen. Perhaps more than any other market, it is set up for a new entrant.

The market opportunity clearly seems to exist. And the major gaming companies are not known to let a new segment grow uninterrupted for too long. So, it will be exciting to see who takes advantage.

For Linden Labs, the creators of Second Life, there’s plenty to be done in the existing spaces. With sexual content fine by the game, the game continues to thrive. The group abandoned plans for their VR-based spiritual successor to Second Life to focus fully on the 19 year-old game.

Another challenge to the adoption of secondary marketplaces by major gaming companies is most of them focus on a direct purchase store model to decrease whaling and wealth inequality making the game uneven. It is against the ethics of these game developers to have items available for hundreds of thousands of dollars.

The most likely option to succeed may be games like Blankos Block Party by Mythical Games. Blankos is willing to price high and go limited. The game’s $300 NFT collaboration with British fashion house Burberry sold out in 30 seconds.

Big NFT Companies like Dapper Labs are not going to let this market go without them. The next NFT marketplace the company plans to develop after its hits with NBA Top Shot and Cryptokitties is to be called Genies Marketplace. Genies will have a focus on digital wearables for avatars.

Companies like Dapper and Mythical are play-to-earn first, so the developers have a different attitude to issues of wealth inequality. Other games built within a console context are unlikely to take that approach.

Takeaways for the Gaming Industry

As a result, perhaps the surest major impact of digital fashion remains to be quite trivial in terms of change, but large in terms of magnitude: digital fashion looks set to increase the value and sales of in-game cosmetics dramatically in the near future.

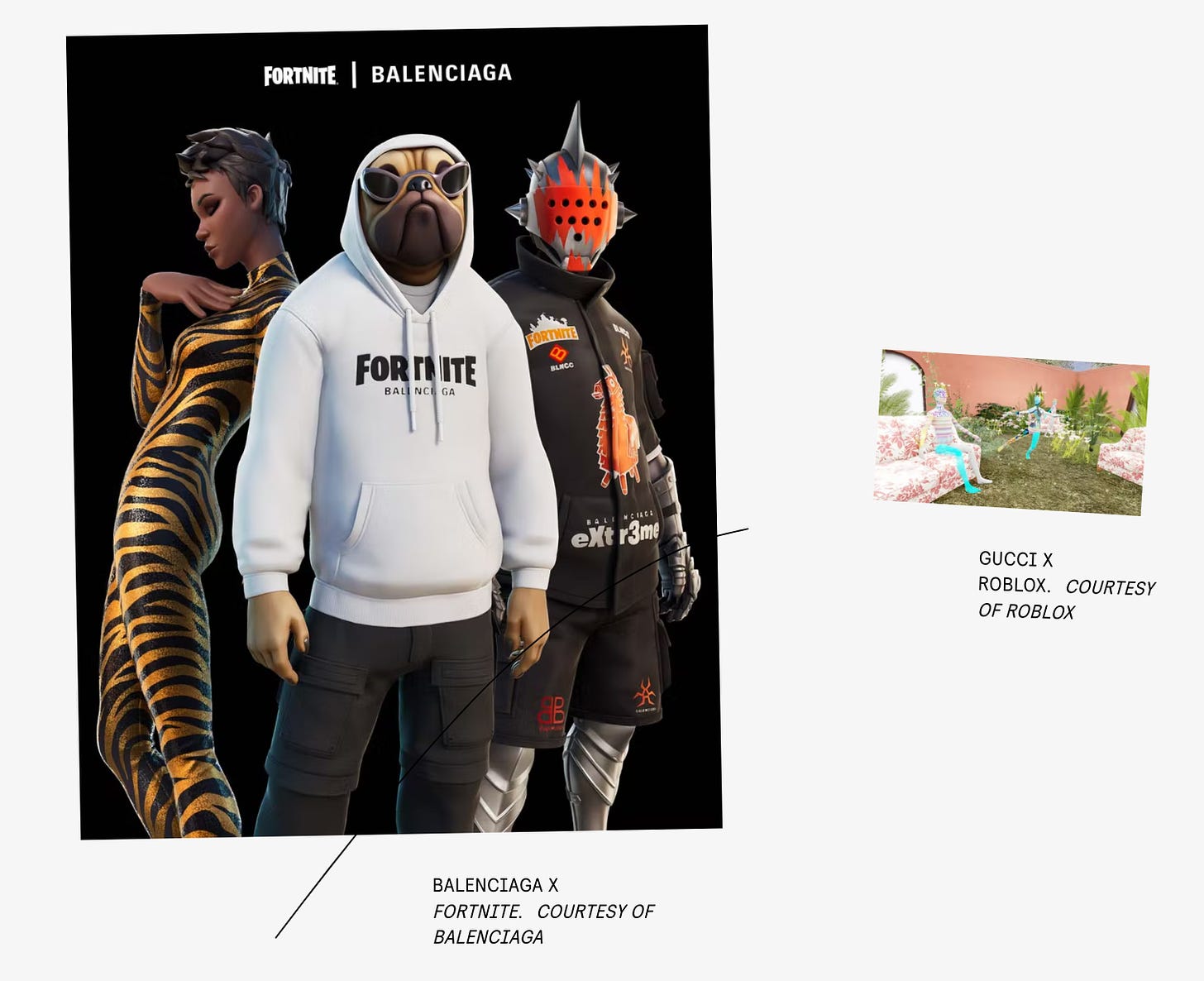

Both in the US and across the world, more beauty and fashion brands will be eager to do limited drops with gaming collaborators. Expect many more Gucci x Roblox and Balenciaga x Fortnite style collaborations.

Were digital fashion to really expand into blockchain like applications with secondary markets, it could turn into a huge market beyond cosmetics. But, that would probably require the entry of the major gaming studios into UGC-driven marketplaces that cater to wealth inequality. That seems unlikely in the current environment.