Trend among fast growing tech companies

A trend is spreading through many of the fastest growing technology companies – they are building in house ad technology stacks. Here are just a few of the awesome companies building in house ad tech:

- Zynga (68% Q1 YoY growth on $404M revenue)

- Wayfair (49% Q1 YoY growth on $2.33B revenue)

- Avalara (39% Q1 YoY ARR growth on $120M base)

- Best Buy (37% domestic Q1 YoY growth on $7.91B revenue)

- Zulily (19% Q1 YoY growth on $760M revenue)

- Airbnb (5% Q1 YoY growth on $842M revenue)

These are not companies building sell-side inventory purchasing options. These are companies building buy-side advertising technology stacks in house. There is a range of gaming, direct to consumer e-commerce, B2B SaaS, retail, and travel companies known for building this type of in-house ad tech. This is not just restricted to public companies either. Hot startups like Instacart, fresh off doubling its valuation in less than 5 months in March, also are developing in-house ad tech.

Despite all the interest, the topic is still a relatively new one. For the most part, companies only started down this journey in the last few years. The earliest players started 10 or maybe 15 years ago. As a result, from the perspective of a technologist and product person, there are still few resources online and what to build, when, or how. So, I set out to talk to product teams building these products, research pre-existing growth content on the topic, and comb through JDs for clues on whether you should build in-house ad tech.

When to begin exploring in-house ad tech

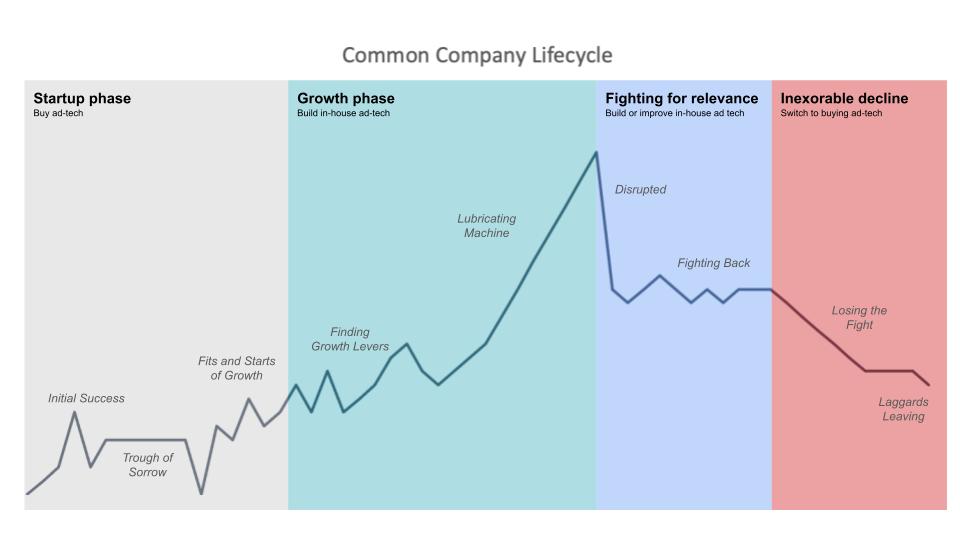

Doing the right technology work at the right time is half the battle in product strategy. In-house ad technology is primarily the type of pursuit companies should only do in the growth phase (Zynga -> Airbnb) or fighting for relevance phase (eg, Capital One).

In the startup phase, product work generally should be directed towards finding product market fit. So, if the core business involves advertising technology, a company should build in-house ad-tech. Otherwise, they probably should not. Instead of devoting scarce and valuable PM, data science, and engineering resources down the path of in-house ad technology, I would recommend buying it. There is a rich set of third–party ad technology SaaS providers throughout the ad technology stack.

As Y Combinator has explained wonderfully, after the wave of initial success, most startups are going to hit a long trough of sorrow. One of the easiest mistakes is to start building in-house ad tech before making it through the trough of sorrow. Exceptional top of the funnel can rarely remedy a core user experience that is a leaky bucket.

After the trough of sorrow comes the testing of growth levers phase. This is one of the best times to think about building (or purchasing if you have not) in-house ad tech. Usually, the core user experience is in place, product market fit is in place, and the business can begin to find reliable growth levers. One great method to approach it when you start is to get a skunkworks team going. They can experiment into lightweight hypotheses about where buy-side ad-tech could help your business.

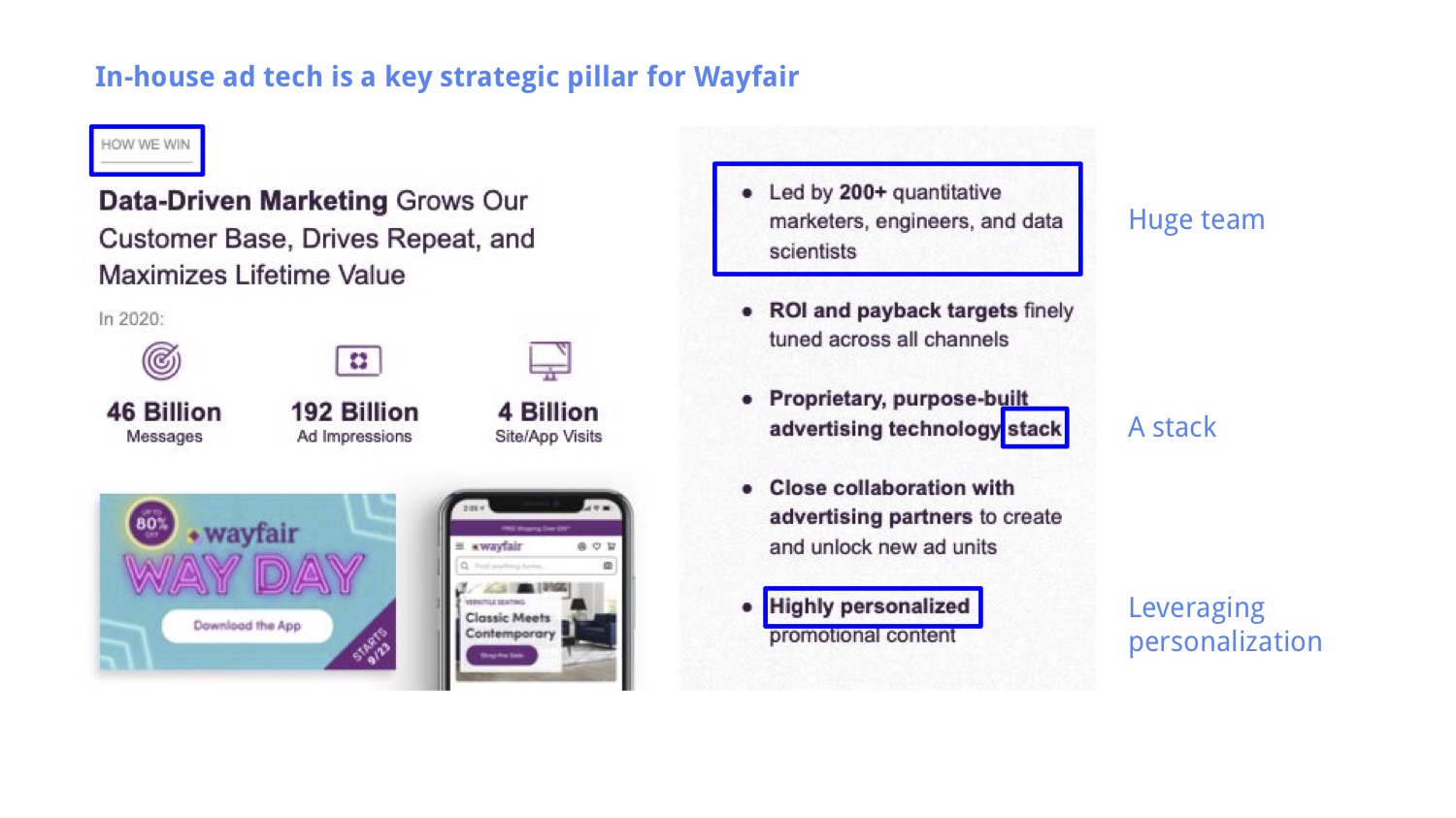

After that team has sometime to run, is an important decision point for the business. Ad technology may or may not become a growth lever. The business should decide. If they decide to pursue it, this lever can become a huge investment. Multiple companies have shown can be invested in with significant teams. Wayfair’s team is 200+, as this page from their investor presentation shows. The ad-tech lever becomes part of the lubricating machine and becomes part of the cycle where the company generates a lot of value. Think about the late stages of many high growth companies like Netflix, with its extraordinary continuous net adds.

On the other hand, if the ad technology is not driving efficiency, cost saving, scale, ROI, competitive advantage, or privacy benefits, it can be time to cut the lever to focus on better things. Purchasing ad-tech or using the network’s built-in tools very well might be the best option.

Eventually, most growth companies enter the phase where they are fighting for relevance. This can actually be an interesting time to experiment with investing in in-house ad tech. It can be a driver of renewed competitive advantage against startups who potentially have a superior product or new distribution channel. It can be a good way to establish another vector of competition. Ad inventory for any given market is limited, after all. So, this is an interesting time to consider investing in building or improving in-house ad technology.

In the end, most companies do tend to eventually hit an inexorable decline. This is as sure a time as any to stop investing in growth product like ad technology. At that point, it usually makes sense to cut back and harvest for profits.

Why to build in-house ad tech

If you are the right stage of company, then the next question to ask yourself is if the business case is compelling enough in your very specific case. Recent surveys by the IAB target a few key reasons that companies take at least their programmatic display in-house: ROI attribution, better audience targeting, campaign effectiveness, cost efficiency, real-time optimization, data management, cross-channel planning and execution, and extended audience reach. These reasons generally resonate for ad-technology as a whole but have a few gaps.

If we were to think of a ‘mutually exclusive, completely exhaustive’ (MECE) structure to understand the potential ‘why’ reasons to build in-house ad tech more broadly, we can start with three reasons at the highest level: revenue, cost, and strategy. Starting with revenue, in-house ad tech can potentially drive increased scale and ROI on ad spend. Within the cost bucket, in-house ad tech can also drive savings on ad spend. Finally, there is the strategic advantage bucket. Ad tech can provide a moat against competitors, greater privacy with your customer’s data, or other strategic advantages.

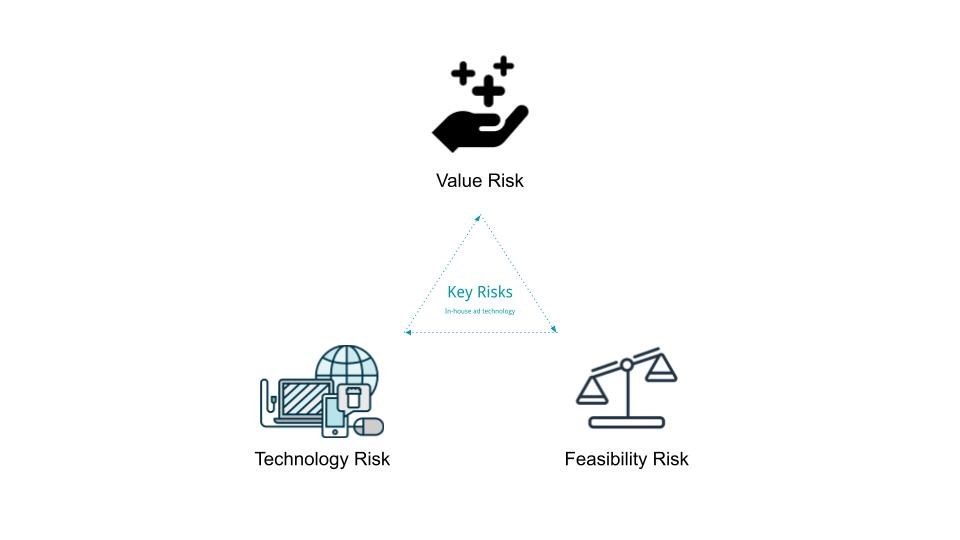

So, to decide whether these reasons are compelling for your business, if you are in the right stage of company, several criteria can be important to evaluate. One framework that I would suggest you use is that of three key risks.

First, value risk. The product may not deliver the value you thought. Do you have a compelling story of how the technology will deliver revenue, cost, or strategic value? Very often the path to positive ROI or scale from in-house ad tech can be a long and arduous journey. The returns do not materialize overnight. For many, they come about over the course of years. So, there is substantial value risk of whether the in-house ad tech will deliver. You have to assess if your business has a use case to build around that is compelling enough.

Second, technology risk. The product may not be technologically doable. The interconnected system of ad APIs, internal marketing users, your server, the platforms, and other data is a complex web. Most ad technology stacks eventually build in data science models to drive components of them as well. The many layers of complex technology becomes a system to maintain. And there are significant areas where the technology may not pan out for your team. An API may change that prevents the use case you were building for. Google could change the algorithm. Facebook could evolve as a platform.

Third, feasibility risk. Your team may not be able to build it. There is a chance that the value and technology risks are okay, but you still fail because the vision is not realized. Many companies have experienced this in their investments into ad technology. In fact, the graveyard of attempts might be as deep as the number of companies still investing. To prevent a graveyard attempt, you have to very honestly evaluate your capacity as a team and company. Is this the type of technology your company can succeed at building? If so, how can you help ensure it succeeds?

Takeaway

If your company is the right stage, and you can tell your team a reasonable story around value, technology, and feasibility risks, then it might be time for you to test building in-house ad technology.