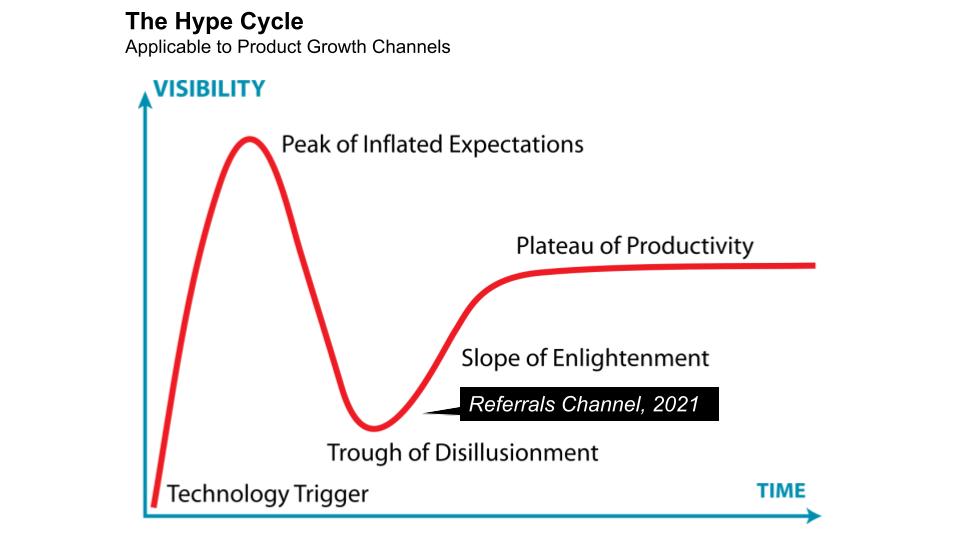

Coming out of the Trough of Disillusionment 🕳️

Many of the hottest consumer product companies have recently rapidly scaled through the referrals channel. Robinhood, valued at $36B, recently published that over 80% of its customers were acquired organically or through referrals. Clubhouse achieved hockey-stick growth to a $4B valuation a year after its founding. Tesla also continues to iterate on its program.

This is a bit of déjà vu for long time product growth practitioners. We remember the first wave the channel had around 2000, and its relentless rise till about 2012. But, since then, most of us saw it peter out. In fact, after years of failed attempts to scale, many of us have deprioritized initiatives in the channel. But as the channel shows signs of a volume revival, let’s take deep dive into whether you, too, should once again invest in your referrals channel.

What Caused the Trough? 😔

Paypal created a technology trigger moment in 2000, when it started offering money for free on the web. This started over a decade of innovation in the referrals channel. Tons of companies began experimenting with giving users money for referrals. But content was relatively sparce for product growth folks.

In the early 2010s, the channel began to reach a peak of inflated expectations. The growth of Dropbox, Uber, and Airbnb via referrals was very public, rapid, and newsworthy. The channel drove the highest quality and largest volume of supply at Airbnb. Content on the channel and its performance became ubiquitous. This led to myriad imitations, including SaaS providers offering every D2C & B2B brand under the sun $10 – $10 out of the box rewards capability.

Eventually, consumers became de-sensitized to the offer. Too many companies were rolling out the same messaging, rewards, and distribution points. It was a game of copycat. This reduced the volume of customers coming in through the channel over time. Even worse from a metrics perspective, the consumers who did care were the least valuable.

The Latest Wave of Referrals 🌊

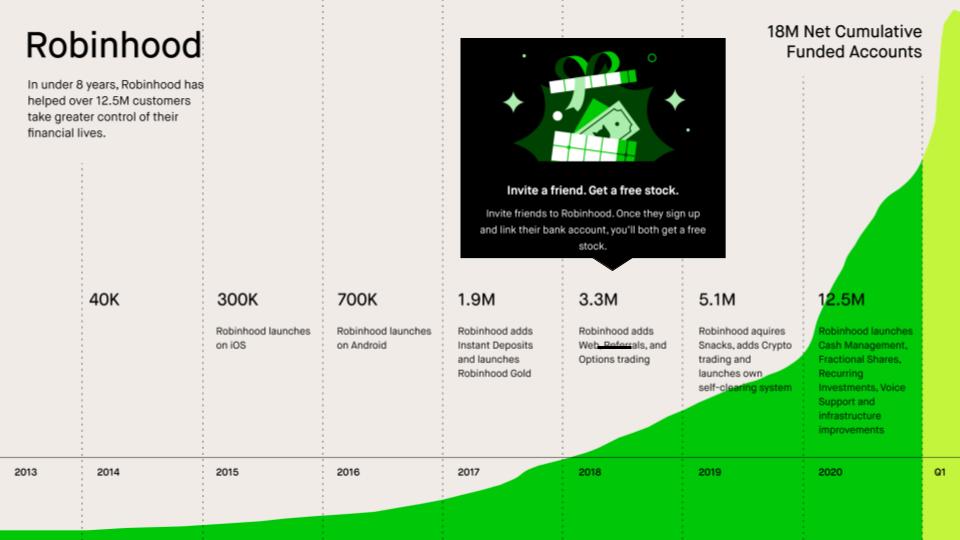

Robinhood

Users of Robinhood ~2018 saw almost daily reminders in the notification center about how they could get a big-name stock like Amazon, or the even more expensive Berkshire-Hathaway. Amazon stock currently goes for $3200. It is very exciting to have the prospect to own a whole Amazon stock, just by convincing your friend to deposit $1 into a Robinhood account. Robinhood added the loot box concept to Referrals rewards. They also innovated on product marketing. They had a had a high frequency of slightly different messaging.

It’s incredible to see how after they added referrals in 2018, they saw another step change increase in growth.

The team has continued to iterate since the original implementation. Now, stocks are limited to the $500 price point, and the max total reward from stocks you can get is $500 as a referrer. They likely saw deteriorating quality from some accounts after they referred a certain amount. That’s exactly the type of iteration and fine-tuning that can drive continued sustainability of the channel.

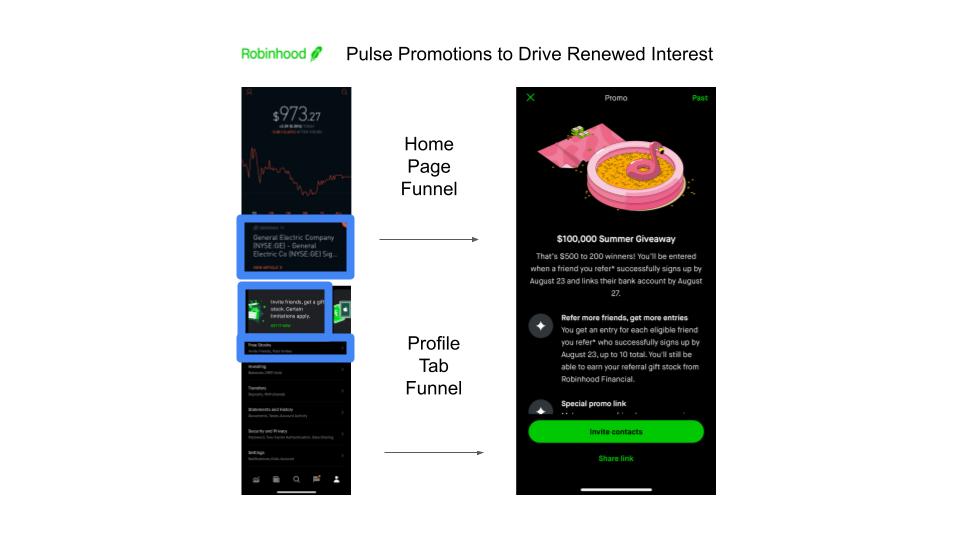

They also run pulse promotions. They are currently running a $100,000 summer giveaway. What’s amazing is how they leverage their top in-app surface to drive to this special referrals promo. These are the types of programs you can consider investing in with the referrals product growth channel.

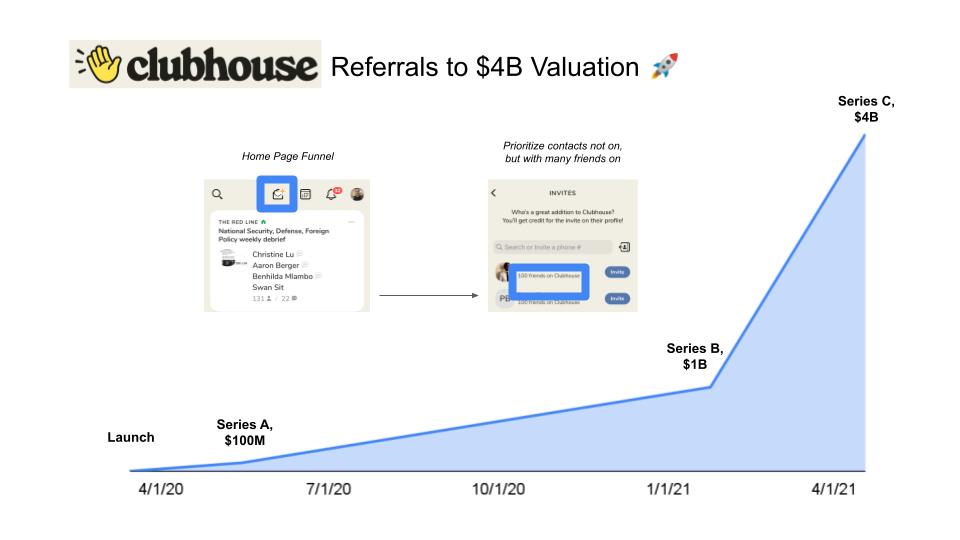

Clubhouse

Clubhouse has been one of the hottest startups to quickly rise. The company was only founded last year. But the clubhouse product growth team plugged into one of the most underused lists on everyone’s phone: contacts. They used this list to architect a referrals program that made referrers feel good about referring. They were letting their friends (often who they hadn’t talked to in a while since the contacts are an old data store) in on a cool new social network.

The Clubhouse product growth team combined contacts with exclusivity and FOMO to help encourage almost everyone in tech, venture capital, and tech reporting to join the app.

Tesla

Did you know the king of product growth titans, Tesla, leans heavily on its referral programs? The company has no PR department and a $0 advertising budget, but it has a referrals program that it has consistently iterated on as a product growth channel. If the channel is good enough for Elon to keep around & iterate upon, it’s at least worth thinking about if you should as well.

Should you invest in Referrals? 💰

Referrals turns out to be an expensive to channel to iterate in. The touchpoints of the program are usually numerous. This makes any change to the program fairly developer intensive. Compared to say, influencer, partner, review management, or affiliate marketing, each investment must be made with a much higher bar. There are four key lenses I think of:

- How core is social to your product?

- Can you drive outcomes that are a focus for the business?

- Do you have an innovative angle to bring to market?

- How has your program previously performed?

How core is social to your product? 🗣️

All three case studies we went over were products that are inherently social:

- Stocks are something a certain segment of society loves to talk about their friends with.

- People love showing off and talking about their car.

- Clubhouse was an inherently social audio app.

On the other hand, people do not love talking about their utility company or payday lender. So, if people do not want to talk about your product, if social is not core to it, investing in referrals may not be the best option for you.

The best programs are not just for social products, but the reward is part of the core loop of the product. For instance, Robinhood’s stocks-based referrals program leverages the stock-trading core loop of the product.

Can you drive outcomes that are a focus for the business? 🔦

What are the goals for your company? What are the user segments your product and growth teams want to focus on? You can potentially architect the program to focus on that group. Take Fortnite’s example. The game has 300M+ players already, but it has less active. So, the product growth team focused on reactivating churned users.

Investing in referrals really sings when it aligns with a broader corporate objective like that – to drive reactivation, for instance.

Do you have an innovative angle to bring to market? ✨

As any growth marketer can tell you, early volume on a channel is always better than late volume. If you are headed to the market with the same old tired referrals strategy another company has implemented, it is far less likely to generate excitement.

On the other hand, if you are able to drive an innovative offer, engagement mechanism, or even distribution, or branding to the market, this will give your channel a much better chance to succeed. Even the best referrals channels constantly need to be rebranded with fresh rewards and schemes.

How has your program previously performed? 📊

If you have implemented a program in the past, I recommend two key north star metrics to evaluate where the program is at now:

- LTV / CAC: What is the payback period for users? How can you segment this to understand groups to focus more or less on?

- Volume: What is the percent of new users generated by referrals (or reactivated if you are focused on that segment)? What is the max volume it has been?

Programs that have hopeless payback periods or small volumes might be indicators that you fail on one of the above three questions. Is that rectifiable? Then maybe you should invest to rectify. If you already have decent payback, should you experiment increasing the CAC to increase volume? With similar lines of questioning and reactions, these two data points should be your north stars for iterating and improving upon the program.

The future of the referrals channel ↗️

My forecast for the channel is bright. I think that we are just now moving up the slope of enlightenment. More and more product teams will find innovative ways to integrate referrals into the products. That will lead to innovative consumer value, driving incremental growth of the channel. For the most part, the channel is only driving 5-10% of new users. But word of mouth is the oldest channel in the books. It is only natural for that share to grow over time.